Long-Term Financial Planning

EXAMPLES

Long-Term Financial Planning

EXAMPLES

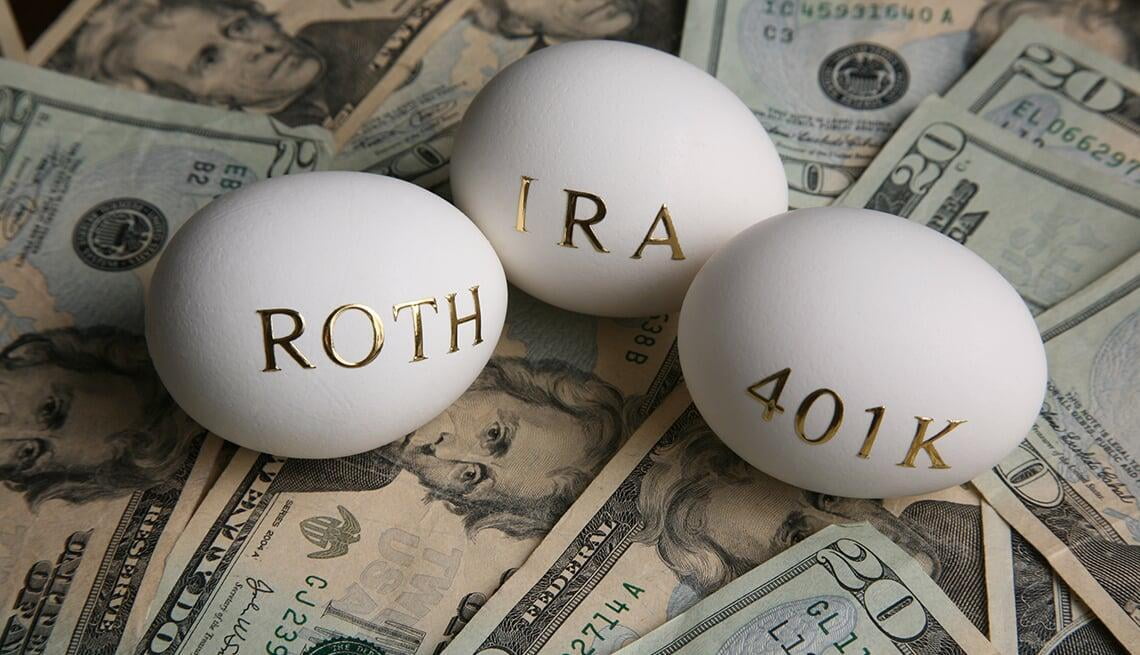

Examples of Retirement Accounts: 401(K), 403(B), 457, Pension Plan, Traditional IRA, SEP IRA, SIMPLE IRA, Roth IRA Etc. Below we will go over in more details about these plans and cover some rules and regulations involved with them. Read more.

A qualified retirement plan is a retirement plan established by an employer that is designed to provide retirement income to designated employees and their beneficiaries

A non-qualified plan is a type of tax-deferred, employer-sponsored retirement plan that falls outside of Employee Retirement Income Security Act (ERISA) guidelines.

Tax-exempt accounts don't deliver a tax benefit when you contribute to them. Instead, they provide future tax benefits; withdrawals at retirement are not subject to taxes.

There are three different types of savings and investment plans when it comes to taxes: tax now accounts, tax later accounts and tax-exempt accounts.

Tax Now Accounts: traditional bank accounts, Checking, Savings, CDs, Brokerage Accounts Mutual Funds. Money in your bank accounts usually are already taxed, earnings on your CD accounts or brokerage accounts are taxed every year as an ordinary income.

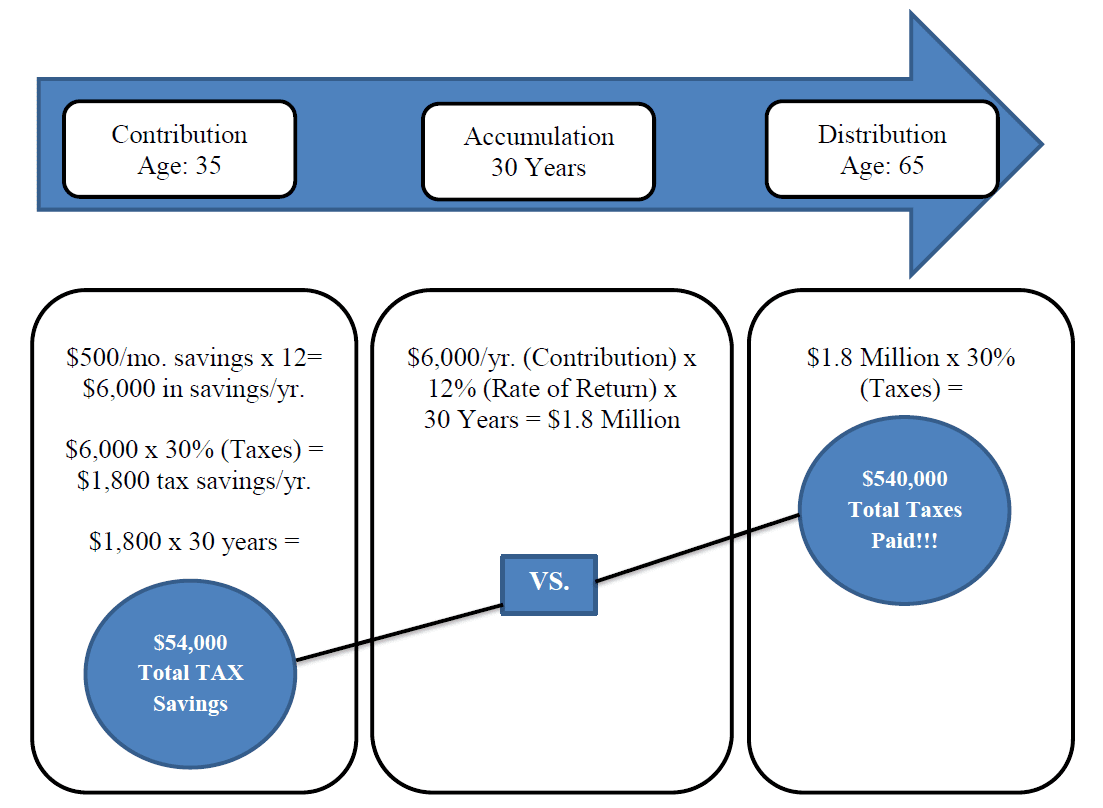

Tax Later Accounts (Tax deferred accounts): all Qualified plans such as 401(K), 403(B), Pension Plan, SEP IRA, SIMPLE IRA, Etc. and Non-Qualified plans such as 457, Traditional IRA, deferred compensation plans, executive bonus plans Etc. Contributions to all these plans are tax deductible, and growth is tax deferred, but withdrawals from these plans are taxed at your prevailing income-tax rate at the time the money is taken out (usually at the retirement). All of these plans have 591/2 rule which means you can’t touch the money inside these plans before 591/2 otherwise you will pay 10% early withdrawal penalty plus state and federal tax and there is also 701/2 rule which means you must take what are called Required Minimum Distributions (RMDs) from the plan, or else face tax penalties.

Tax-Exempt Retirement Accounts: Roth IRA, Roth 401(K), Municipal Bonds, Cash Value Life Insurance Plans. Contributions to all of these plans are not tax deductible, but the earnings then grow tax-deferred and qualified distributions (distributions made after age of 591/2) are free of federal (and possibly state) income tax.