Long-Term Financial Planning

Tax-Exempt Retirement Accounts

Long-Term Financial Planning

Tax-Exempt Retirement Accounts

Tax-exempt accounts don't deliver a tax benefit when you contribute to them. Instead, they provide future tax benefits; withdrawals at retirement are not subject to taxes. Since contributions into the account are made with after-tax dollars, there is no immediate tax advantage. The primary benefit of this type of structure is that investment returns grow tax-free.

IMPORTANT: Your current and expected future tax brackets are the primary driving factors in determining which account is most suitable for your tax-planning needs.

So there are only 3 types of Tax-Exempt investment/savings accounts in the United States:

- Roth IRA, Roth 401(k)/403(b)/457(b)

- Municipal Bonds

- Cash Value Life Insurance (Permanent Insurance) also known as Life Insurance Retirement Strategy (LIRS)

By contrast, in a regular taxable investment portfolio, the owner would pay capital gains taxes on that $1,427 of growth when they sold the investments. And with a tax-deferred account, the owner would pay ordinary income tax when they took distributions from their account—contributions or earnings. Note that the long-term capital gains tax is lower than the regular income tax.

With a tax-deferred account, taxes are paid in the future, but taxes are paid right now with a tax-exempt account. However, major advantages can be realized by shifting the period when you pay taxes and allowing for tax-free investment growth.

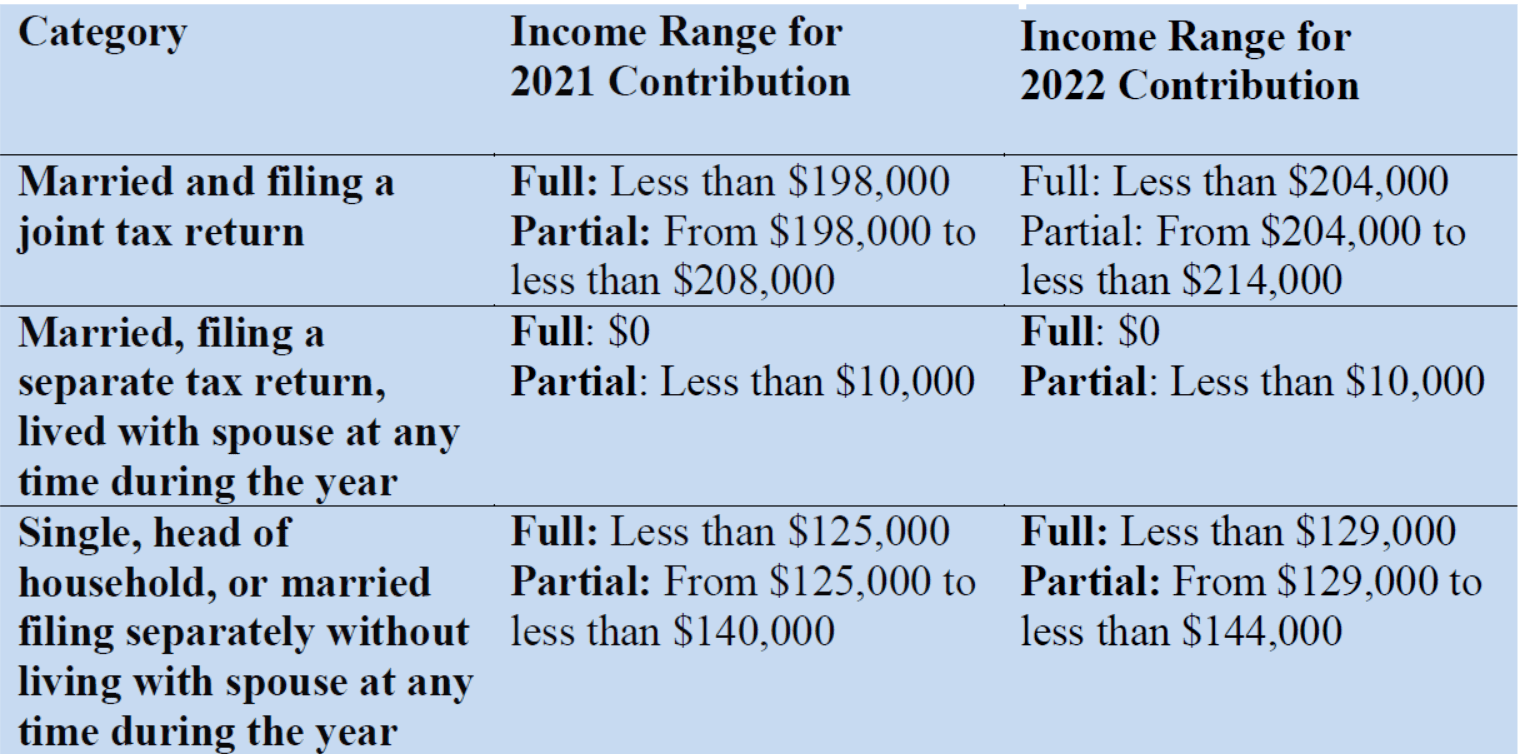

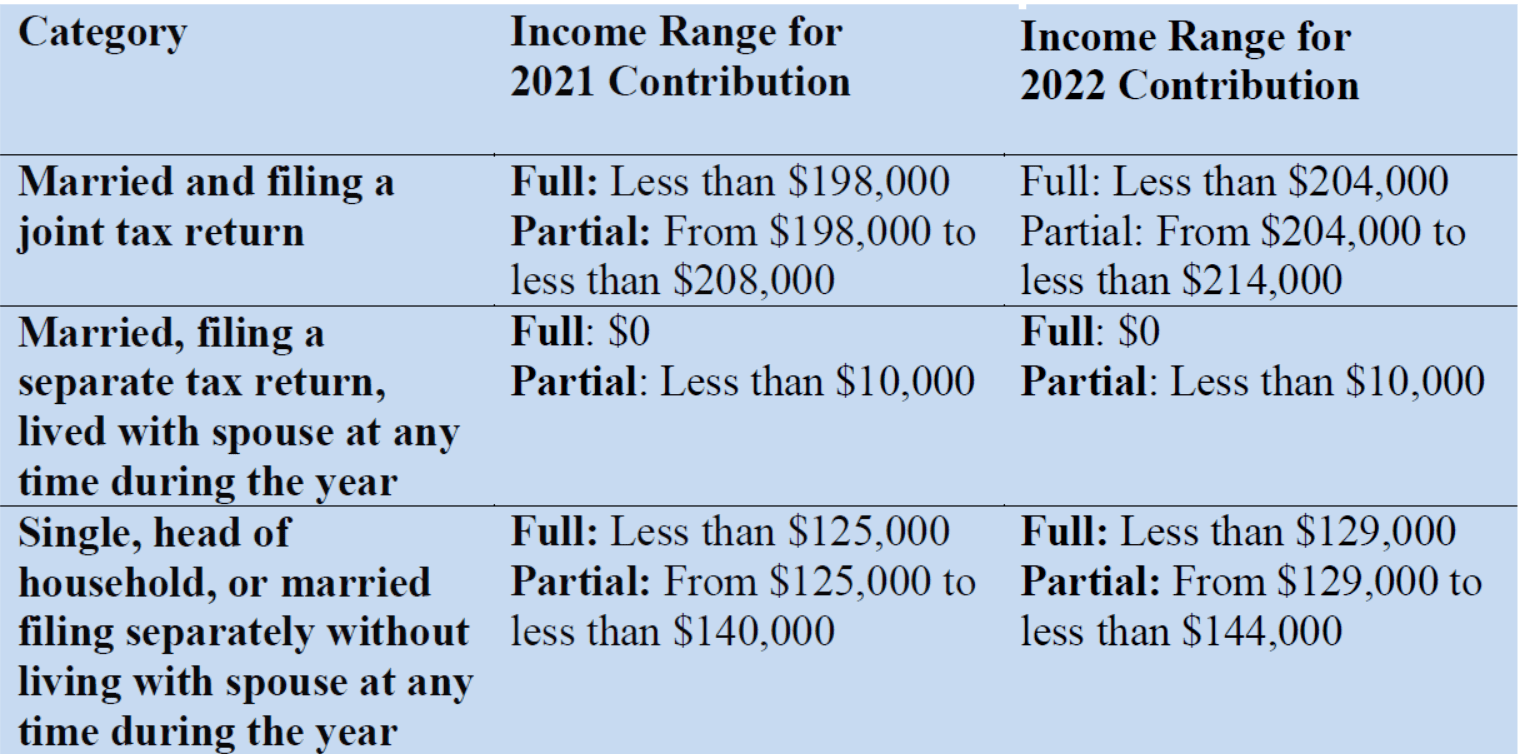

Contribution limits for Roth IRAs and Roth 401(k)s are the same as for traditional IRAs and 401(k)s, but people whose modified adjusted gross income (MAGI) is too high may not be able to contribute to Roth IRAs.

A Roth IRA is an Individual Retirement Account to which you contribute after-tax dollars. While there are no current-year tax benefits, your contributions and earnings can grow tax-free, and you can withdraw them tax- and penalty-free after age 591/2 and once the account has been open for five years.

What Is a Roth IRA?

A Roth IRA is a type of tax-advantaged individual retirement account to which you can contribute after-tax dollars. The primary benefit of a Roth IRA is that your contributions and the earnings on those contributions can grow tax-free and be withdrawn tax-free after the age 591/2 assuming the account has been open for at least five years. Roth IRAs are similar to traditional IRAs, with the biggest distinction being how the two are taxed. Roth IRAs are funded with after-tax dollars—this means that the contributions are not tax-deductible, but once you start withdrawing funds, the money is tax-free.

How Roth IRA Works

Similar to other qualified retirement plan accounts, the money invested within the Roth IRA grows tax-free. However, a Roth IRA is less restrictive than other accounts.4 The account holder can maintain the Roth IRA indefinitely; there are no required minimum distributions (RMDs) during their lifetime, as there are with 401(k)s and traditional IRAs.

Conversely, traditional IRA deposits are generally made with pretax dollars; you usually get a tax deduction on your contribution and pay income tax when you withdraw the money from the account during retirement.6

A Roth IRA can be funded from a number of sources:- Regular contributions

- Spousal IRA contributions

- Transfers

- Rollover contributions

- Conversions

Contributing to Roth IRAAll regular Roth IRA contributions must be made in cash (which includes checks and money orders)—they can’t be in the form of securities or property. The Internal Revenue Service (IRS) limits how much can be deposited annually in any type of IRA, adjusting the amounts periodically. The contribution limits are the same for traditional and Roth IRAs. These limits apply across all your IRAs, so even if you have multiple accounts you can't contribute more than the maximum.For 2021 and 2022, the standard contribution limit for both traditional and Roth IRAs is $6,000. If you’re 50 years of age or older, the IRS provides a catch-up feature that allows you to contribute an extra $1,000 each year for a total of $7,000.2

- Regular contributions

- Spousal IRA contributions

- Transfers

- Rollover contributions

- Conversions

2021

- For workers under 50 years old, the total contributions to Roth IRA cannot exceed $6,000 per year.

- If we include the catch-up contribution for those 50 and over, the limit is $7,000.

2022

- For workers under 50 years old, the total contributions to Roth IRA cannot exceed $6,000 per year.

- If we include the catch-up contribution for those 50 and over, the limit is $7,000.

Allowable Investments in a Roth IRA

Once the funds are contributed, a variety of investment options exist within a Roth IRA, including mutual funds, stocks, bonds, exchange-traded funds (ETFs), certificates of deposit (CDs), money market funds, and even cryptocurrency.

Note that IRS rules mean that you cannot contribute cryptocurrency directly into your Roth IRA. However, the recent emergence of “Bitcoin IRAs” has created retirement accounts designed to let you invest in cryptocurrencies. The IRS also lists other assets that are not permitted within an IRA, such as life insurance contracts and derivative trades.

If you want the broadest range of investment options, you need to open a Roth self-directed IRA (SDIRA) a special category of Roth IRA in which the investor, not the financial institution, manages their investments. These unlock a universe of possible investments. In addition to the standard investments (stocks, bonds, cash, money market funds, and mutual funds), you can hold assets that aren’t typically part of a retirement portfolio. Some of these include gold, investment real estate, partnerships, and tax liens—even a franchise business.

IMPORTANT: The maximum annual contribution that an individual can make to a Roth IRA in 2021 remains the same in 2022. Those ages 50 and older can contribute up to $7,000.

Who’s Eligible for a Roth IRA?Anyone who has earned income can contribute to a Roth IRA—as long as they meet certain requirements concerning filing status and modified adjusted gross income (MAGI). Those whose annual income is above a certain amount, which the IRS adjusts periodically, become ineligible to contribute. The chart below shows the compensation limits for 2021 and 2022.

Compensation Limits:

Taking Withdrawals From Roth IRA

Qualified Distributions

- For workers under 50 years old, the total contributions to Roth IRA cannot exceed $6,000 per year.

- If we include the catch-up contribution for those 50 and over, the limit is $7,000.

- For workers under 50 years old, the total contributions to Roth IRA cannot exceed $6,000 per year.

- If we include the catch-up contribution for those 50 and over, the limit is $7,000.

At any time, you may withdraw contributions from your Roth IRA, both tax- and penalty-free. If you take out only an amount equal to the sum that you’ve put in, then the distribution is not considered taxable income and is not subject to penalty, regardless of your age or how long it has been in the account.

However, there’s a catch when it comes to withdrawing account earnings: any returns that the account has generated. For distribution of account earnings to be considered a qualified distribution, it must occur at least five years after the Roth IRA owner established and funded their first Roth IRA, and the distribution must occur under at least one of the following conditions:- The Roth IRA holder is at least age 591/2 when the distribution occurs.

- The distributed assets are used toward purchasing—or building or rebuilding—a first home for the Roth IRA holder or a qualified family member (the IRA owner’s spouse, a child of the IRA owner or of the IRA owner’s spouse, a grandchild of the IRA owner and/or of their spouse, or a parent or other ancestor of the IRA owner or of their spouse). This is limited to $10,000 per lifetime.

- The distribution occurs after the Roth IRA holder becomes disabled.

- The assets are distributed to the beneficiary of the Roth IRA holder after the Roth IRA holder’s death.

The Five-Year RuleWithdrawal of earnings may be subject to taxes and/or a 10% penalty, depending on your age and whether you’ve met the five-year rule.11 Here’s a quick rundown.If you meet the five-year rule:- Under age 591/2: Earnings are subject to taxes and penalties. You may be able to avoid taxes and penalties if you use the money for a first-time home purchase (a $10,000 lifetime limit applies), if you have a permanent disability, or if you pass away and your beneficiary takes the distribution.

- Ages 591/2 and older: No taxes or penalties.

If you don’t meet the five-year rule:- Under age 59½: Earnings are subject to taxes and penalties. You may be able to avoid the penalty (but not the taxes) if you use the money for a first-time home purchase (a $10,000 lifetime limit applies), qualified education expenses, unreimbursed medical expenses, if you have a permanent disability, or if you pass away and your beneficiary takes the distribution.

- Ages 59½ and older: Earnings are subject to taxes but not penalties.

IMPORTANT: Roth IRA withdrawals are made on a first in, first out (FIFO) basis—so any withdrawals made come from contributions first. Therefore, no earnings are considered touched until all contributions have been taken out.

Non-Qualified DistributionsA withdrawal of earnings that do not meet the above requirements is considered a non-qualified distribution and may be subject to income tax and/or a 10% early distribution penalty. There may be exceptions, however, if the funds are used:- For unreimbursed medical expenses if the distribution is used to pay unreimbursed medical expenses for amounts that exceed 7.5% of the individual’s adjusted gross income (AGI) for 2021 and prior tax years.

- To pay medical insurance if the individual has lost their job.

- For qualified higher education expenses if the distribution goes toward qualified higher education expenses of the Roth IRA owner and/or their dependents. These qualified expenses are tuition, fees, books, supplies, and equipment required for the enrollment or attendance of a student at an eligible educational institution and must be used in the year of the withdrawal.

- For childbirth or adoption expenses if they're made within one year of the event and don't exceed $5,000.

Note that if you withdraw only the amount of your contributions made within the current tax year—including any earnings on those contributions—then the contribution is reversed. For example, if you contribute $5,000 in the current year and those funds generate $500 in earnings, you can withdraw the $5,000 principal tax- and penalty-free and the $500 gain will be treated as taxable income.

Required Minimum Distribution (RMDs)At some point, all individual retirement accounts (IRAs), both Roth and traditional, must have their balances distributed to the account owner or the owner’s beneficiaries. A key difference between the two types of IRAs is that you don’t have to take any distributions from a Roth IRA during your lifetime if you are the original owner.

Required minimum distributions (RMDs) represent the minimum amount of money that you must take out of your retirement account each year after reaching a certain age. That amount is specified by the Internal Revenue Service (IRS) and, in the case of traditional IRAs, the withdrawal will be taxed as income at your current tax rate. The IRS also imposes a 50% penalty on any missed RMDs.2

You must begin taking RMDs from a traditional IRA by April 1 of the year after you turn 72 (the old threshold of 70½ still applies if you hit that age by Jan. 1, 2020). You must take them even if you don’t need the money for living expenses. The amount of your RMD is based on your prior year’s account balance (as of Dec. 31) and your age at the time. Many other types of retirement accounts, including 401(k) plans, follow a similar set of rules. You must almost always pay income taxes on those withdrawals.3

One of the great advantages of Roth IRAs is that they are not subject to the same RMD rules. If you have a Roth IRA, you don’t have to take RMDs from it during your lifetime. So if you don’t need the money, you can leave the funds untouched and let the account grow tax-free (possibly for decades) for your heirs. Your beneficiaries—other than a surviving spouse—must take RMDs from your account after they inherit it.

- The Roth IRA holder is at least age 591/2 when the distribution occurs.

- The distributed assets are used toward purchasing—or building or rebuilding—a first home for the Roth IRA holder or a qualified family member (the IRA owner’s spouse, a child of the IRA owner or of the IRA owner’s spouse, a grandchild of the IRA owner and/or of their spouse, or a parent or other ancestor of the IRA owner or of their spouse). This is limited to $10,000 per lifetime.

- The distribution occurs after the Roth IRA holder becomes disabled.

- The assets are distributed to the beneficiary of the Roth IRA holder after the Roth IRA holder’s death.

- Under age 591/2: Earnings are subject to taxes and penalties. You may be able to avoid taxes and penalties if you use the money for a first-time home purchase (a $10,000 lifetime limit applies), if you have a permanent disability, or if you pass away and your beneficiary takes the distribution.

- Ages 591/2 and older: No taxes or penalties.

- Under age 59½: Earnings are subject to taxes and penalties. You may be able to avoid the penalty (but not the taxes) if you use the money for a first-time home purchase (a $10,000 lifetime limit applies), qualified education expenses, unreimbursed medical expenses, if you have a permanent disability, or if you pass away and your beneficiary takes the distribution.

- Ages 59½ and older: Earnings are subject to taxes but not penalties.

- For unreimbursed medical expenses if the distribution is used to pay unreimbursed medical expenses for amounts that exceed 7.5% of the individual’s adjusted gross income (AGI) for 2021 and prior tax years.

- To pay medical insurance if the individual has lost their job.

- For qualified higher education expenses if the distribution goes toward qualified higher education expenses of the Roth IRA owner and/or their dependents. These qualified expenses are tuition, fees, books, supplies, and equipment required for the enrollment or attendance of a student at an eligible educational institution and must be used in the year of the withdrawal.

- For childbirth or adoption expenses if they're made within one year of the event and don't exceed $5,000.

A designated Roth account is a separate account in a 401(k), 403(b) or governmental 457(b) plan to which designated Roth contributions are made. Designated Roth contributions are not excluded from gross income and are currently taxed. Qualified distributions from a Roth account, including earnings, are excluded from gross income.

What Is a Roth 401(K), 403(B) or 457(B) Plan ?

A Roth 401(k)/403(b) or 457(b) refer to an employer-sponsored retirement savings accounts that is funded using after-tax dollars. This means that income tax is paid immediately on the earnings that the employee deducts from each paycheck and deposits into the account. Withdrawals from these accounts are tax-free upon retirement. This type of plans are different from a traditional 401(k) or 403(B) plans, which is funded with pretax money. In this case, payroll deductions come out of the employee's gross income and taxes are due only when the money is withdrawn from the account.

How These Plans Work?

A Roth 401(k)/403(b) or 457(b) refer to an employer-sponsored retirement savings accounts that is funded using after-tax dollars. This means that income tax is paid immediately on the earnings that the employee deducts from each paycheck and deposits into the account. Withdrawals from these accounts are tax-free upon retirement. This type of plans are different from a traditional 401(k) or 403(B) plans, which is funded with pretax money. In this case, payroll deductions come out of the employee's gross income and taxes are due only when the money is withdrawn from the account.

The plan must separately account for contributions, gains and losses to this account. A SARSEP or SIMPLE IRA plan may not offer designated Roth accounts.

A 401(k), 403(b) or governmental 457(b) plan may permit employees to designate some or all of their plan elective deferrals as after-tax Roth contributions. SARSEP and SIMPLE IRA plans may not offer designated Roth accounts.

To have a designated Roth contribution program, the plan document must be amended to provide:

- Separate accounts for designated Roth contributions

- A choice of both pre-tax and Roth elective deferrals

- That only Roth elective deferrals may be contributed to the designated Roth account (not profit-sharing or employer matching contributions or forfeitures)

Plans offering designated Roth accounts may include:

- Automatic enrollment of participants (including for designated Roth contributions)

- Plan loans

- Employer matching contributions (must be contributed to another account, not to the designated Roth account)

- In-plan rollovers to designated Roth accounts

Employer matching and profit-sharing contributionsOnly employee elective deferrals may be contributed to a designated Roth account. Matching contributions and profit-sharing contributions may not be made directly to the designated Roth account. An employer may use designated Roth deferrals in calculating a matching contribution, but the match amount must be contributed to another account within the plan.

Tax treatment of designated Roth contributions

Designated Roth contributions are treated the same as pre-tax elective deferrals for many purposes, including:- The annual contribution limits,

- Non-forfeitability and distribution restrictions,

- Nondiscrimination testing,

- Required minimum distributions, and

- Calculation of the plan's deduction limits under Internal Revenue Code Section 404.

Contributing to a designated Roth account

Employers may offer employees an opportunity to make after-tax salary deferral contributions to a separate designated Roth account in the employer's 401(k), 403(b) or governmental 457(b) retirement plan. Unlike pre-tax elective deferrals, the amount employees contribute to a designated Roth account is includible in gross income. However, distributions from the account are generally tax-free, including previously untaxed earnings in the account. (See which qualified distributions are tax-exempt).

Benefits of designated Roth accounts

Compared to a Roth IRA, designated Roth accounts:

- Offer larger annual contribution limits than Roth IRAs,

- Are not subject to the modified gross income limitations that restrict some individuals from contributing to Roth IRAs, and

- Allow participants to keep their Roth and pre-tax savings within a single plan.

See our Roth Comparison Chart and Ten Differences between a Roth IRA and a Designated Roth Account for help in deciding whether to contribute to a Roth IRA, designated Roth account or pre-tax elective deferral account. Each type of account has different benefits and features.

Contribution Limits

A 401(k), 403(b) or governmental 457(b) plan may permit employees to designate some or all of their plan elective deferrals as after-tax Roth contributions. SARSEP and SIMPLE IRA plans may not offer designated Roth accounts.

To have a designated Roth contribution program, the plan document must be amended to provide:

- Separate accounts for designated Roth contributions

- A choice of both pre-tax and Roth elective deferrals

- That only Roth elective deferrals may be contributed to the designated Roth account (not profit-sharing or employer matching contributions or forfeitures)

Plans offering designated Roth accounts may include:

- Automatic enrollment of participants (including for designated Roth contributions)

- Plan loans

- Employer matching contributions (must be contributed to another account, not to the designated Roth account)

- In-plan rollovers to designated Roth accounts

- The annual contribution limits,

- Non-forfeitability and distribution restrictions,

- Nondiscrimination testing,

- Required minimum distributions, and

- Calculation of the plan's deduction limits under Internal Revenue Code Section 404.

- Offer larger annual contribution limits than Roth IRAs,

- Are not subject to the modified gross income limitations that restrict some individuals from contributing to Roth IRAs, and

- Allow participants to keep their Roth and pre-tax savings within a single plan.

The combined amount a participant may contribute as pre-tax elective deferrals and designated Roth contributions each taxable year is limited. Total contributions to the plan are limited to $20,500 in 2022 ($19,500 in 2020 and 2021; $19,000 in 2019) plus for employees age 50 or older, an additional $6,500 in 2020, in 2021 and in 2022 ($6,000 in 2015 - 2019). For later years, the limits are subject to cost-of-living adjustments.

2021

- The total contributions to designated Roth accounts cannot exceed $19,500 per year.

- If we include the catch-up contribution for those 50 and over, the limit is $26,000.

2022

- For workers under 50 years old, the total contributions to traditional IRA cannot exceed $20,500 per year.

- If we include the catch-up contribution for those 50 and over, the limit is $27,000.

Distributions from a designated Roth accountA qualified distribution from a designated Roth account is excludable from gross income. A qualified distribution is one that occurs at least five years after the year of the employee's first designated Roth contribution (counting the first year as part of the five) and is made:

The combined amount a participant may contribute as pre-tax elective deferrals and designated Roth contributions each taxable year is limited. Total contributions to the plan are limited to $20,500 in 2022 ($19,500 in 2020 and 2021; $19,000 in 2019) plus for employees age 50 or older, an additional $6,500 in 2020, in 2021 and in 2022 ($6,000 in 2015 - 2019). For later years, the limits are subject to cost-of-living adjustments.

2021

- The total contributions to designated Roth accounts cannot exceed $19,500 per year.

- If we include the catch-up contribution for those 50 and over, the limit is $26,000.

2022

- For workers under 50 years old, the total contributions to traditional IRA cannot exceed $20,500 per year.

- If we include the catch-up contribution for those 50 and over, the limit is $27,000.

- On or after attainment of age 591/2,

- On account of the employee's disability, or

- On or after the employee's death.

Nonqualified distributionsA distribution that is not a qualified distribution will be partially included in gross income if there are earnings in the account.- The distribution will be treated as coming pro-rata from earnings and contributions (basis).

- The 10% tax on early withdrawals may apply to the part of the distribution that is includible in gross income.

Required Minimum Distribution (RMDs)

- On or after attainment of age 591/2,

- On account of the employee's disability, or

- On or after the employee's death.

- The distribution will be treated as coming pro-rata from earnings and contributions (basis).

- The 10% tax on early withdrawals may apply to the part of the distribution that is includible in gross income.

Designated Roth accounts are subject to the required minimum distribution rules that apply to 401(k), 403(b) and governmental 457(b) plans. In general, if the participant is retired or an owner, the participant must start receiving distributions from the plan at age 72 (701/2 if reach 701/2 before January 1, 2020), and annual withdrawals will be required based on his or her remaining life expectancy at the time of the withdrawal. Roth IRAs, in comparison, do not require minimum distributions at age 72 (701/2 if reach 701/2 before January 1, 2020).

Investing in municipal bonds is a good way to preserve capital while generating interest. Most of them are exempt from federal taxes, and some are tax-free at the state and local level as well. 1 Municipal bonds, also called munis, help build infrastructure in your area.

What Is a Municipal Bond?

Municipal bonds (or “munis” for short) are debt securities issued by states, cities, counties and other governmental entities to fund day-to-day obligations and to finance capital projects such as building schools, highways or sewer systems. By purchasing municipal bonds, you are in effect lending money to the bond issuer in exchange for a promise of regular interest payments, usually semi-annually, and the return of the original investment, or “principal.” A municipal bond’s maturity date (the date when the issuer of the bond repays the principal) may be years in the future. Short-term bonds mature in one to three years, while long-term bonds won’t mature for more than a decade.

How Municipal Bond Works?

A municipal bond is a debt obligation issued by a nonprofit organization, a private-sector corporation, or another public entity using the loan for public projects such as constructing schools, hospitals, and highways.Municipal bonds can generate tax-free income for qualified residents but pay lower coupon (interest) rates as a result compared with taxable bonds.

Generally, the interest on municipal bonds is exempt from federal income tax. The interest may also be exempt from state and local taxes if you reside in the state where the bond is issued. Bond investors typically seek a steady stream of income payments and, compared to stock investors, may be more risk-averse and more focused on preserving, rather than increasing, wealth. Given the tax benefits, the interest rate for municipal bonds is usually lower than on taxable fixed-income securities such as corporate bonds.

Types of Municipal Bonds

A municipal bond is categorized based on the source of its interest payments and principal repayments. A bond can be structured in different ways, offering various benefits, risks, and tax treatments. Income generated by a municipal bond may be taxable. For example, a municipality may issue a bond not qualified for federal tax exemption, resulting in the generated income being subject to federal taxes.The two most common types of municipal bonds are the following:- General obligation bonds are issued by states, cities or counties and not secured by any assets. Instead, general obligation are backed by the “full faith and credit” of the issuer, which has the power to tax residents to pay bondholders.

- Revenue bonds are not backed by government’s taxing power but by revenues from a specific project or source, such as highway tolls or lease fees. Some revenue bonds are “non-recourse,” meaning that if the revenue stream dries up, the bondholders do not have a claim on the underlying revenue source.

In addition, municipal borrowers sometimes issue bonds on behalf of private entities such as non-profit colleges or hospitals. These “conduit” borrowers typically agree to repay the issuer, who pays the interest and principal on the bonds. In cases where the conduit borrower fails to make a payment, the issuer usually is not required to pay the bondholders.

Where can investors find information about municipal bonds?Investors wishing to research municipal bonds may access a range of information online free of charge at the Municipal Securities Rulemaking Board’s Electronic Municipal Market Access (EMMA) website. Information available to you includes:- Disclosure documents going back as early as 1990, including a bond’s official statement, which is a disclosure document similar to a prospectus that includes important characteristics, such as type, yield, maturity, credit quality, call features and risk factors, as well as audited financial statements, material event notices and other continuing disclosures (including ratings changes, principal and interest payment delinquencies and non-payment related defaults).

- Historical and real-time transaction price data, including information relating to a type of municipal bond called a “variable rate demand obligation” that resets its interest rate periodically. Investors should be aware that recent price information may not be available for bonds that do not trade frequently.

What are some of the risks of investing in municipal bonds?As with any investment, investing in municipal bonds entails risk. Investors in municipal bonds face a number of risks, specifically including:

Call risk. Call risk refers to the potential for an issuer to repay a bond before its maturity date, something that an issuer may do if interest rates decline -- much as a homeowner might refinance a mortgage loan to benefit from lower interest rates. Bond calls are less likely when interest rates are stable or moving higher. Many municipal bonds are “callable,” so investors who want to hold a municipal bond to maturity should research the bond’s call provisions before making a purchase.

Credit risk. This is the risk that the bond issuer may experience financial problems that make it difficult or impossible to pay interest and principal in full (the failure to pay interest or principal is referred to as “default”). Credit ratings are available for many bonds. Credit ratings seek to estimate the relative credit risk of a bond as compared with other bonds, although a high rating does not reflect a prediction that the bond has no chance of defaulting.

Interest rate risk. Bonds have a fixed face value, known as the “par” value. If bonds are held to maturity, the investor will receive the face value amount back, plus interest that may be set at a fixed or floating rate. The bond’s market price will move up as interest rates move down and it will decline as interest rates rise, so that the market value of the bond may be more or less than the par value. U.S. interest rates have been low for some time. If they move higher, investors who hold a low fixed-rate municipal bond and try to sell it before it matures could lose money because of the lower market value of the bond.

Inflation risk. Inflation is a general upward movement in prices. Inflation reduces purchasing power, which is a risk for investors receiving a fixed rate of interest. It also can lead to higher interest rates and, in turn, lower market value for existing bonds.

Liquidity risk. This refers to the risk that investors won’t find an active market for the municipal bond, potentially preventing them from buying or selling when they want and obtaining a certain price for the bond. Many investors buy municipal bonds to hold them rather than to trade them, so the market for a particular bond may not be especially liquid and quoted prices for the same bond may differ.

- General obligation bonds are issued by states, cities or counties and not secured by any assets. Instead, general obligation are backed by the “full faith and credit” of the issuer, which has the power to tax residents to pay bondholders.

- Revenue bonds are not backed by government’s taxing power but by revenues from a specific project or source, such as highway tolls or lease fees. Some revenue bonds are “non-recourse,” meaning that if the revenue stream dries up, the bondholders do not have a claim on the underlying revenue source.

- Disclosure documents going back as early as 1990, including a bond’s official statement, which is a disclosure document similar to a prospectus that includes important characteristics, such as type, yield, maturity, credit quality, call features and risk factors, as well as audited financial statements, material event notices and other continuing disclosures (including ratings changes, principal and interest payment delinquencies and non-payment related defaults).

- Historical and real-time transaction price data, including information relating to a type of municipal bond called a “variable rate demand obligation” that resets its interest rate periodically. Investors should be aware that recent price information may not be available for bonds that do not trade frequently.

Most people haven't heard of this strategy because simply they haven’t had financial professional, most people have CPAs or tax professionals who prepare their taxes but majority of them are not specialized for long term investments or specifically on retirement planning and they don’t have license to talk about cash value life insurance based retirement strategies, on another hand investment advisories (financial advisors) talk all about investments in stock markets , bonds and mutual funds or ETFs and they are not specialized on life insurance based strategies and don’t have a license to conduct such business. It takes unique approach to combine these two things (investments and life insurance). Let’s talk about cash value life insurance, what is it, its types (types of life insurance), how it works, what is LIRS (Life insurance Retirement Strategy) and how it works? But before we start to talk about cash value life insurance and retirement strategies, let’s talk about history of life insurance.

An early form of life insurance dates to Ancient Rome; “burial clubs” covered the cost of members' funeral expenses and assisted survivors financially. The first company to offer life insurance in modern times was the Amicable Society for a Perpetual Assurance Office, founded in London in 1706 by William Talbot and Sir Thomas Allen.

The sale of life insurance in the U.S. began in the 1760s. The Presbyterian Synods in Philadelphia and New York City created the Corporation for Relief of Poor and Distressed Widows and Children of Presbyterian Ministers in 1759; Episcopalian priests organized a similar fund in 1769. Between 1787 and 1837 more than two dozen life insurance companies were started, but fewer than half a dozen survived.

What is Life Insurance?

Life insurance is a contract between an insurer and a policyholder in which the insurer guarantees payment of a death benefit to named beneficiaries upon the death of the insured. The insurance company promises a death benefit in consideration of the payment of premium by the insured. Types of Life Insurance There are two types of life insurance, Term and Permanent and each type has several products.

- Term life insurance.

- Level Term Insurance

- Increasing Term Insurance

- Decreasing Term Insurance

- Permanent Life insurance

- Whole Life Insurance

- Universal Life Insurance (UL)

- Index Universal Life Insurance (IUL)

- Variable Life Insurance (VUL)

To learn more about life insurance, its types and how they work, go to "Protection".

Here, in this section, we are going to cover only permanent life insurance and in particular Indexed Universal Life (IUL) policy and how individuals can build retirement (savings) plans by utilizing IULs.

How Life Insurance Works?

The purpose of life insurance is to provide financial protection to surviving dependents after the death of an insured. It is essential for applicants to analyze their financial situation and determine the standard of living needed for their surviving dependents before purchasing a life insurance policy. Life insurance agents or brokers are instrumental in assessing needs and establishing the type of life insurance most suitable to address those needs. Several life insurance types are available see “Types of life insurance”. It is prudent to re-evaluate life insurance needs annually, or after significant life events like marriage, divorce, the birth or adoption of a child and major purchases, like a house.

There are three major components of a permanent (cash value) life insurance policy.

- Death benefit is the amount of money the insurance company guarantees to the beneficiaries identified in the policy upon the death of the insured. The insured will choose their desired death benefit amount based on estimated future needs of surviving heirs. The insurance company will determine whether there is an insurable interest and if the insured qualifies for the coverage based on the company's underwriting requirements.

- Premium payments are set using actuarially based statistics. The insurer will determine the cost of insurance (COI), or the amount required to cover mortality costs, administrative fees and other policy maintenance fees. Other factors that influence the premium are the insured’s age, medical history, occupational hazards and personal risk propensity. The insurer will remain obligated to pay the death benefit if premiums are submitted as required. With term policies, the premium amount includes the cost of insurance (COI). For permanent policies, the premium amount consists of the COI and a cash value amount.

- Cash value of permanent life insurance is a component which serves two purposes. It is a savings account, which can be used by the policyholder, during the life of the insured, with cash accumulated on a tax-deferred basis, the tax-free withdrawals and policy loans can then be borrowed against cash value (See :IRC 7702). Some policies may have restrictions on withdrawals depending on the use of the money withdrawn. The second purpose of the cash value is to offset the rising cost or to provide insurance as the insured ages.

Now when you have an idea about life insurance and how it works let’s talk about retirement planning based on cash value life insurance. There are several cash value life insurance, the very first life insurance policy was the “whole life” insurance policy, then as any other industry life insurance industry also evolved and 1970s , insurance companies introduced new product called Universal life, after UL around 1980s they introduced Variable Universal Life, then in the late 1990’s some insurance companies developed Indexed Universal Life (IUL) and first introduced in 1997. Minnesota Life, Transamerica and Amerus (now Accordia) were the earliest companies to develop IUL's as part of their product portfolios. But now there are more insurance companies have developed IULs, here are some of them Transamerica, Nationwide, Pacific Life, Fidelity, Prudential Etc. For more information go to Types of life insurance.

What is LIRS (Life Insurance Retirement Strategy)

To understand LIRS, you should understand how Indexed Universal life (IUL) works.

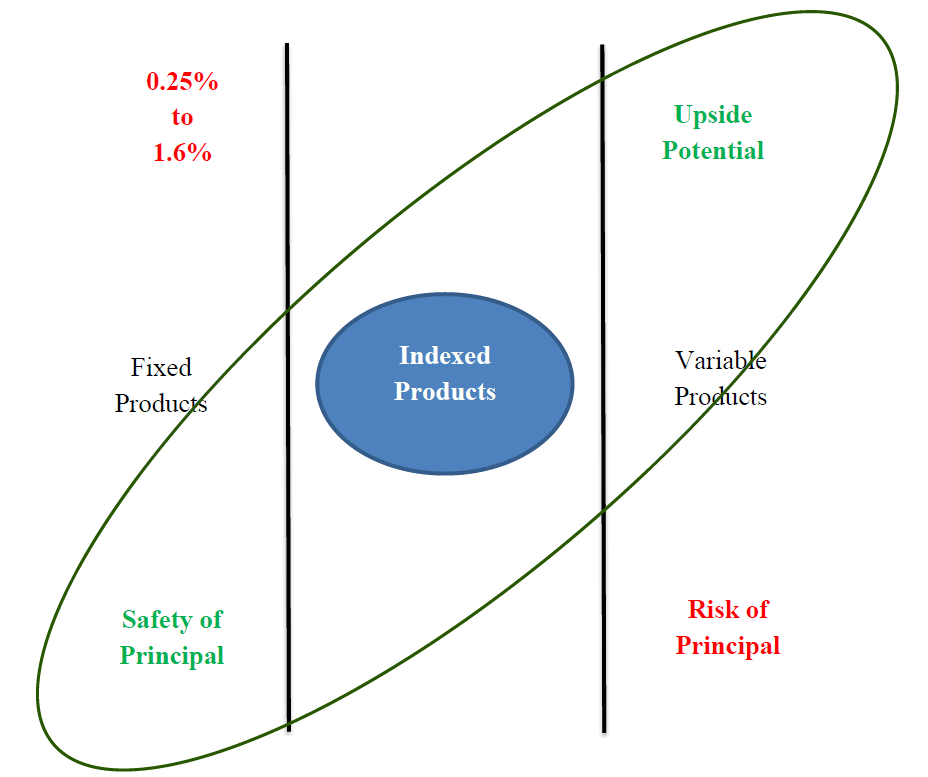

1. Fixed Products

2. Variable Products

But there are Strategies today that give you the Best of both Worlds Safety of Principal with Upside Potential

There are strategies today that can minimize or even eliminate some of the risks that we previously talked about. And one of them is indexed products, which give you the best of both worlds. Safety of the principal and also upside potential. Let’s talk how indexing works.

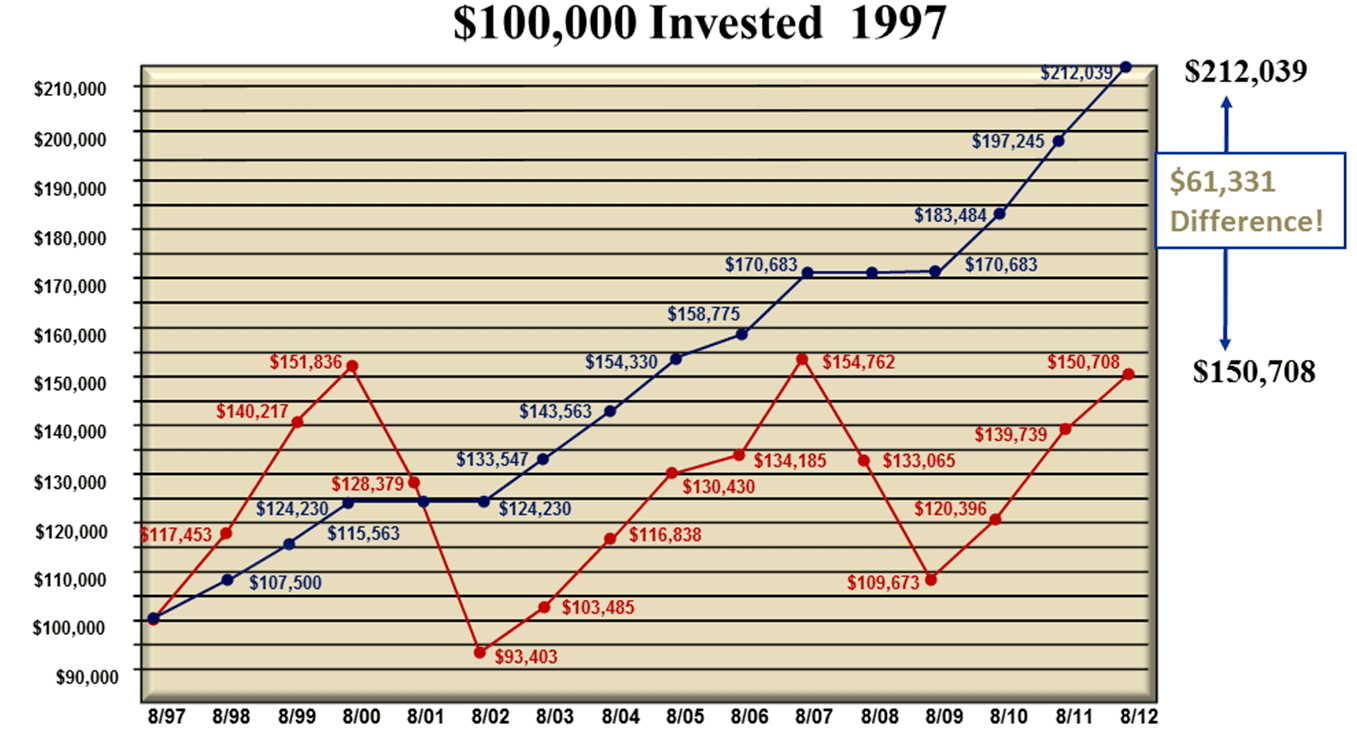

Let’s say you had 100K invested in 1997 for 15 years. This red line is your money in the market (Stock Market). After all these ups and downs and after those 15 years you’ve made about 50 thousand dollars. Blue Line represents the indexed products. Now how the indexing works, first of all your money is not in the market. They just mirror the market (S&P 500, NASDAQ, EURO STOXX 50 Etc.) up to a certain Cap* and there is also floor which is 0% guaranteed but it also could be higher than 0%. So you can see it goes up a little slower because the growth is capped but then you can see when the market drops you just stay right there because of floor (principal protection). POINT WITH LASER TO FIRST DROP. And then when the market picks up again you pick up where you left off vs. everybody else that has to dig themselves out of 36% hole. So the difference in those 15 years 61 thousand dollars. Can anyone use an extra 61K for retirement? We thought so. Okay, so what are your potential options?

*Cap is the maximum percentage that insurance companies can credit to your account.

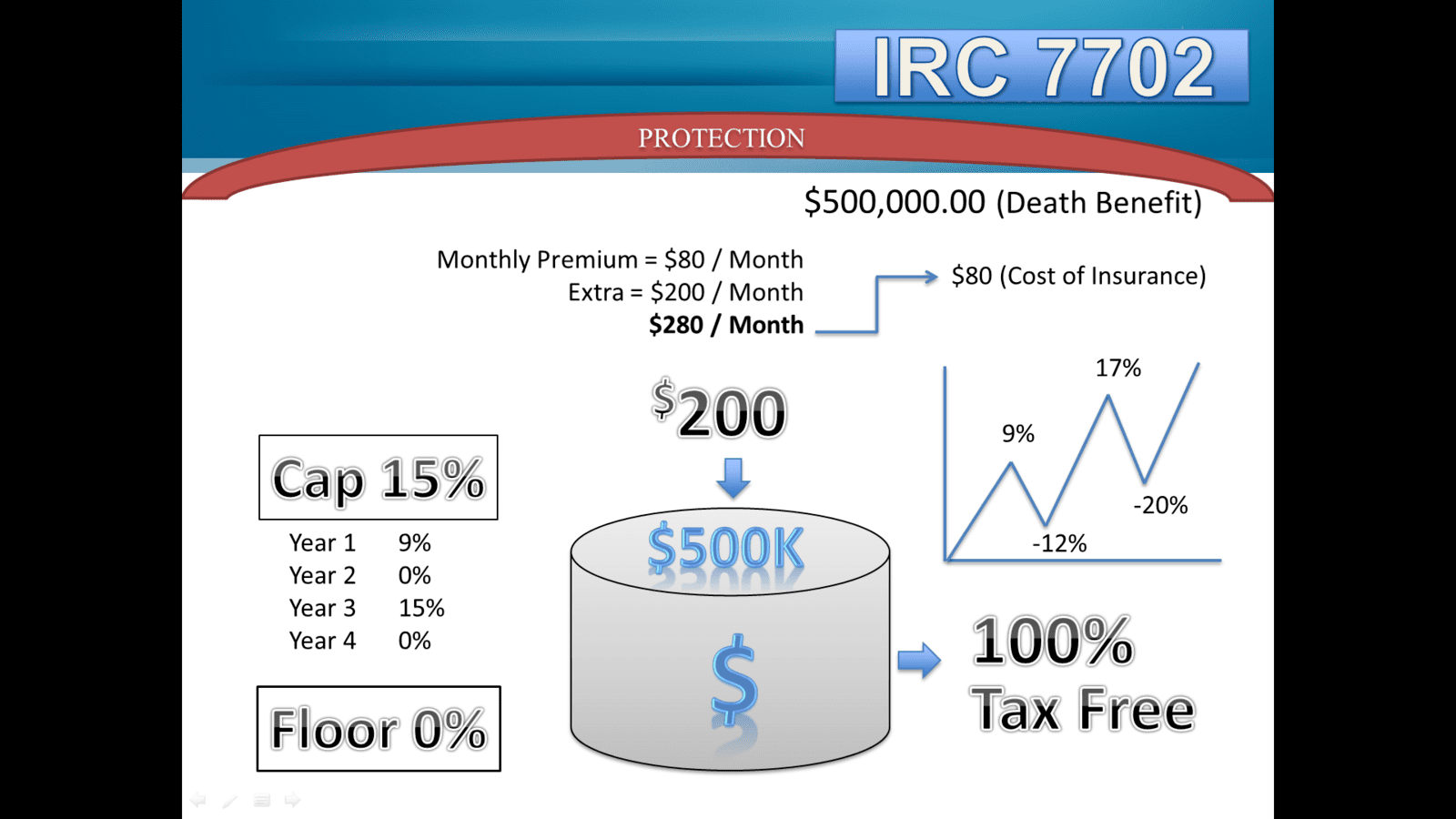

Let's discuss the Indexing and how it works. Let's assume the client bought the protection (life insurance) for his/her family and let's say the initial face amount (death benefit) was $500K and let's assume the coast of insurance (COI) is $80/month (it could vary by policy based on the underwriting factors of Insured, policy administrative and maintenance fees), besides that $80 COI the client decides to send additional $200/month to insurance company, for them to save them into a savings account attached to the life insurance policy where he/she can earn interest on that money based on market performance but the mean time be protected from market downturns (declines) because money in that savings account are not directly invested into the market. Money in that savings account will grow based on market performance but the client can never lose money because there is a floor (principal protection) which can't be below 0% (could be higher then 0%) and they will earn interest based on market performance up to certain Cap in this example the Cap is 15%. Let's say the first year market goes up 9% then in this example the client will earn the whole 9% that year , now let's assume market goes down the next year negative -12% that year the client doesn't earn any interest but what is the most important he/she doesn't lose any money in his/her account the first year gains were locked in, then the following year market recovers up to positive 17% that year the client earns 15% interest because that was his/her Cap in this example and so forth and so on.

This strategy called INDEXING.

Different companies have different Caps and floors but the idea is the same, they provide principal protection (guaranteed floor) with upside potential up to a Cap. Caps can change but insurance companies keep them competitive. Floors can change but they never can go below 0%. This is a hypothetical example for illustration purposes only. Contact financial professional to discuss your specific financial situation and see if an IUL could be a right fit for you.

What is Section 7702? of the U.S. Internal Revenue Code defines what the federal government considers to be a legitimate life insurance contract and determines how such contracts are to be taxed. It applies to life insurance contracts issued after 1985. Section 7702 of the U.S. Internal Revenue Code defines what the federal government considers to be a legitimate life insurance contract and determines how such contracts are to be taxed. It applies to life insurance contracts issued after 1985.

Understanding Section 7702 Prior to the adoption of Section 7702, federal tax law took a fairly hands-off approach when it came to the taxation of life insurance policies. Death benefits paid to life insurance beneficiaries were free from income tax, and any gains that built up within the policy during the policyholder's lifetime were not taxed as part of their income. Aside from the insurance industry's formidable lobbying power, the reasoning behind this favorable tax treatment was that the government did not want to be seen taxing needy beneficiaries—typically widows and children—which would not go over well politically. Life insurance policies that fail to pass the tests in Section 7702 lose any potential tax benefits. Section 7702 was created to differentiate between genuine life insurance policies and investment vehicles masquerading as them and to make sure that only proper policies received the advantageous tax treatment traditionally accorded life insurance.

Under Section 7702, life insurance contracts have to pass one of two tests: the cash value accumulation test (CVAT) or the guideline premium and corridor test (GPT).

- The cash value accumulation test stipulates that the cash surrender value of the contract "may not at any time exceed the net single premium which would have to be paid at such time to fund future benefits under the contract." That basically means that the amount of money the policyholder could get out of the policy if they were to cancel it (often thought of as the "savings" component of cash value life insurance) can't be greater than what the policyholder have paid to purchase the policy with a single lump sum, not including any fees.

- The guideline premium and corridor test requires that "the sum of the premiums paid under such contract does not at any time exceed the guideline premium limitation as of such time." That basically means that the policyholder can't have paid more into the policy than would be necessary to fund its insurance benefits.

What happens if a life insurance contract fails to pass either of those tests? Life insurance contract become a MEC (Modified Endowment Contract) and section 7702(g) stipulates that the "income on the contract" will be treated as ordinary income to the policyholder for that year and taxed accordingly. In other words, it will lose the favorable tax treatment of a true life insurance policy.

In this content, word Market means Stock Market, There are many different stock markets and stock market indexes in the US and other countries around a world, also, market performance means Stock market Index performance. Here are some examples of Stock Market Indexes:

S&P 500: The Standard and Poor's 500, or simply the S&P 500, is a stock market index made up of 500 large companies listed on stock exchanges in the United States, tracking the performance of large-cap stocks.

NASDAQ: Also used to refer to the Nasdaq Composite is a stock market index that includes almost all stocks listed on the Nasdaq stock exchange,

an index of more than 3,700 stocks listed on the Nasdaq exchange that includes technology giants Apple Inc. (AAPL), Microsoft (MSFT), Google parent Alphabet (GOOG, GOOGL), Meta Platforms Inc. (META), Amazon.com Inc. (AMZN) and Tesla Inc. (TSLA).

Dow Jones Industrial Average: The Dow Jones Industrial Average, Dow Jones, or simply the Dow, is a price-weighted measurement stock market index of 30 prominent companies listed on stock exchanges in the United States.

EURO STOXX 50: The EURO STOXX 50 is a stock index of Eurozone stocks designed by STOXX, an index provider owned by Deutsche Börse Group. As of April 2021, the index was dominated by France and Germany. According to STOXX, its goal is "to provide a blue-chip representation of Supersector leaders in the Eurozone".

Hang Seng Index: The Hang Seng Index is a free float-adjusted market-capitalization-weighted stock-market index in Hong Kong. It is used to record and monitor daily changes of the largest companies of the Hong Kong stock market and is the main indicator of the overall market performance in Hong Kong.

Go to Solutions to download the app and find out how much you might need at the time of your retirement and how much you should save to meet those financial goals.

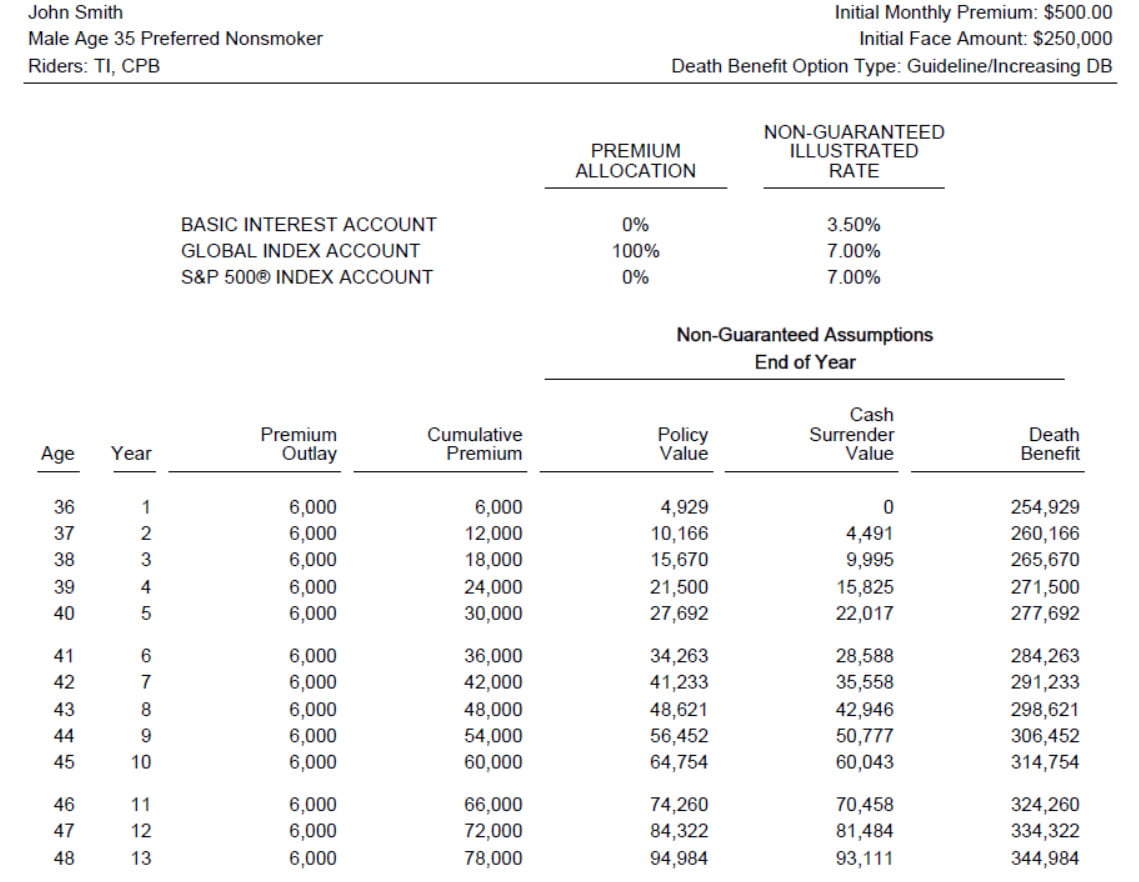

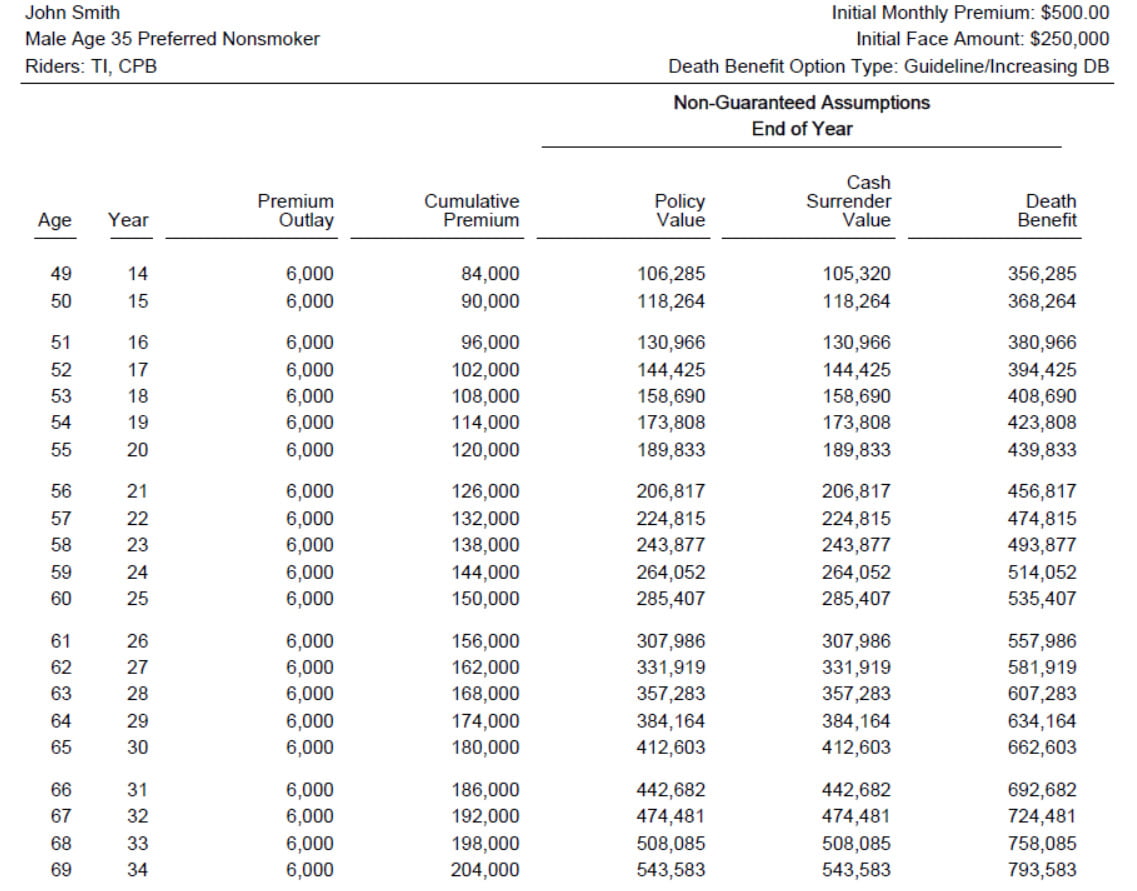

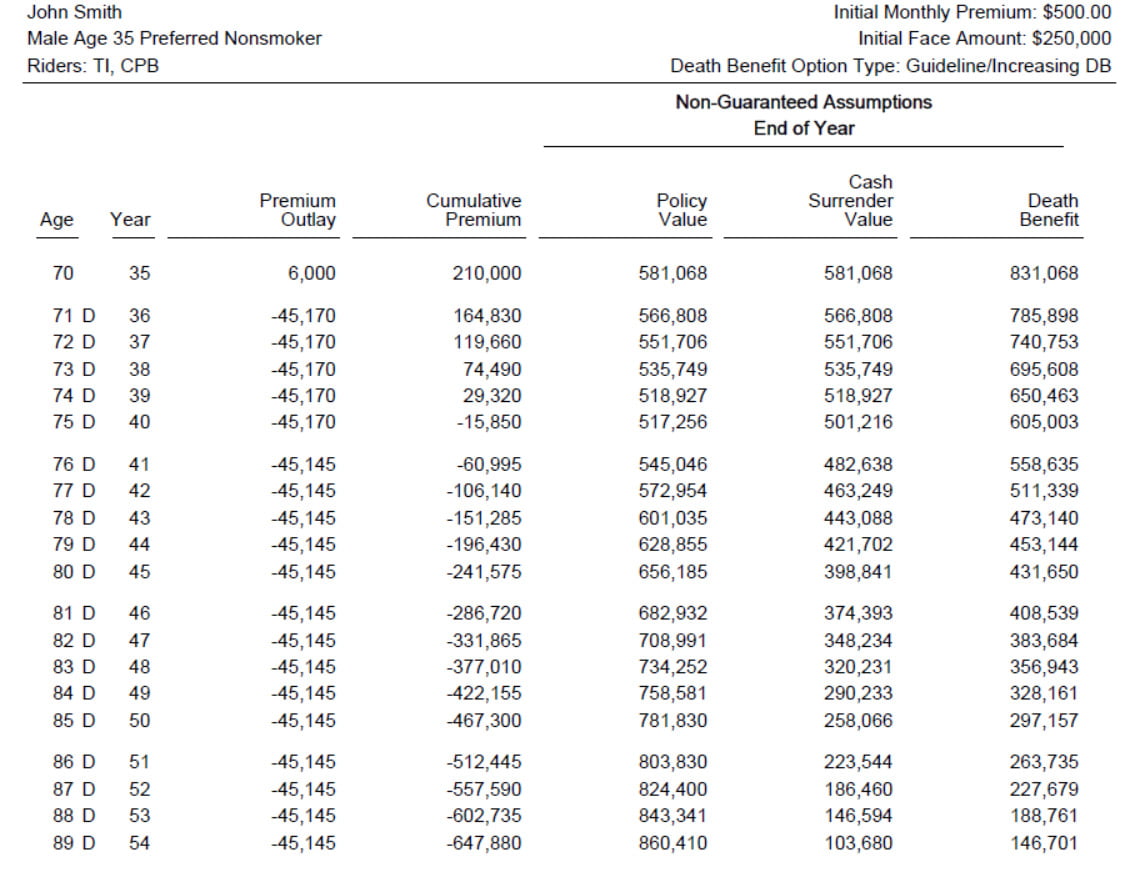

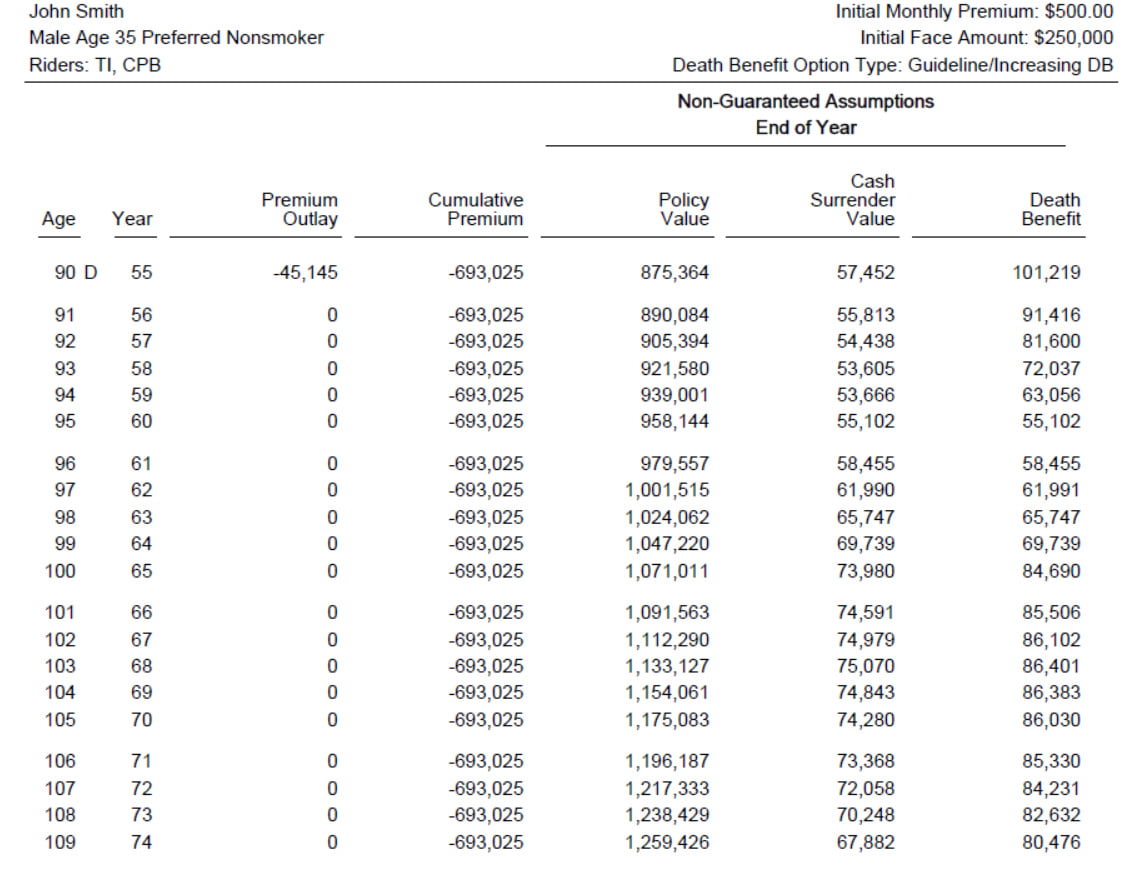

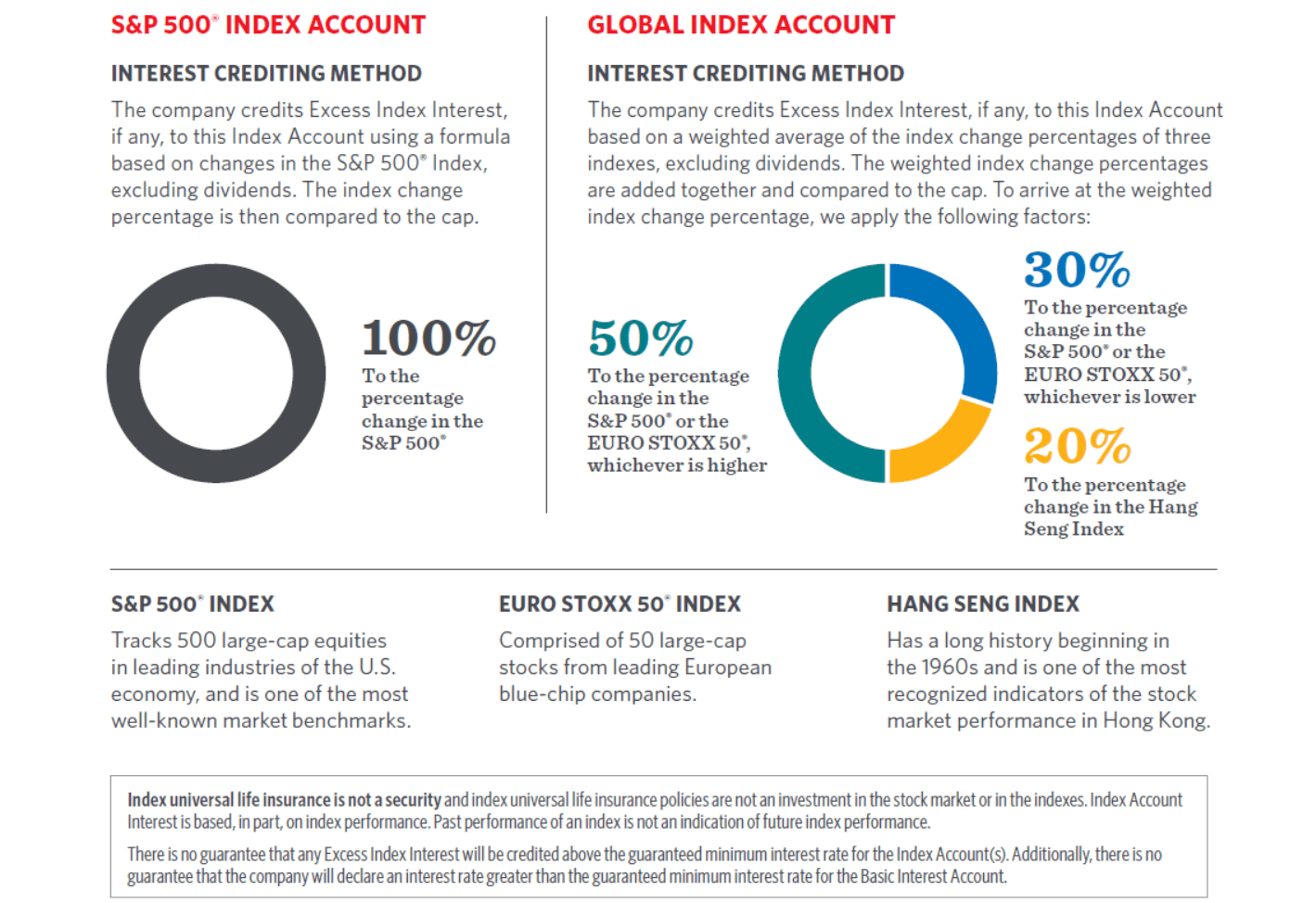

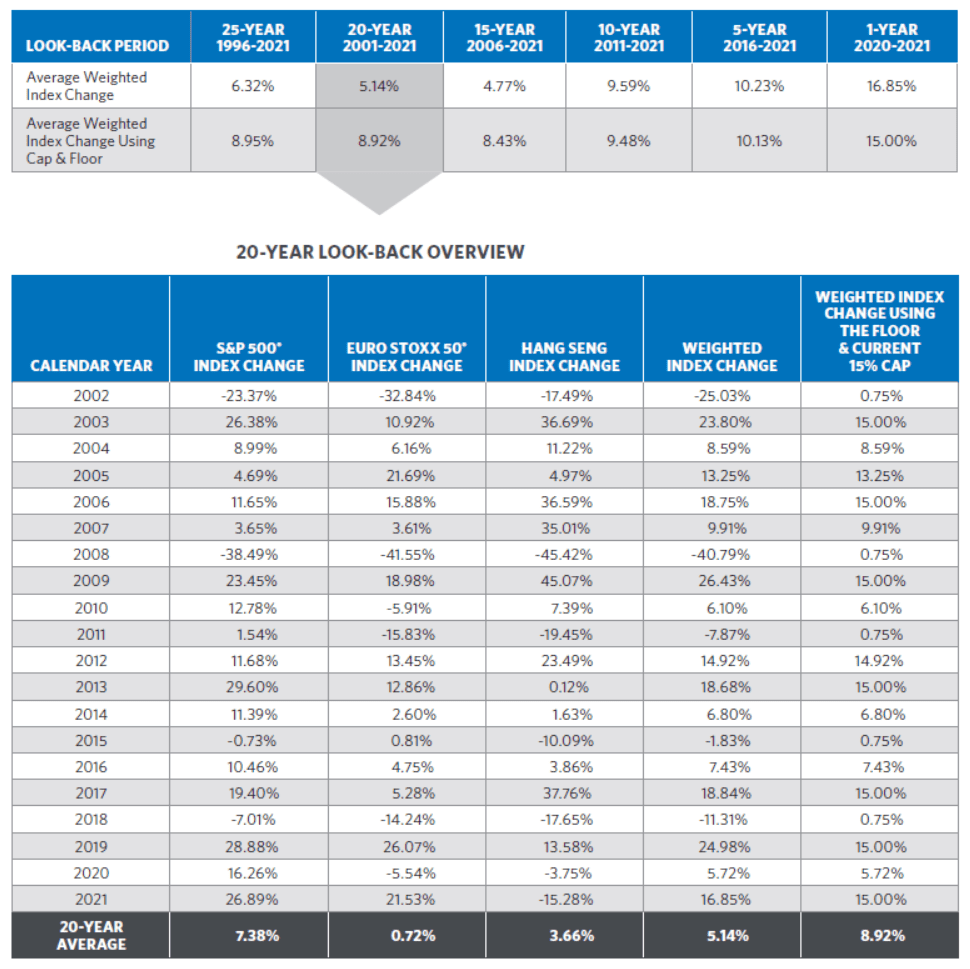

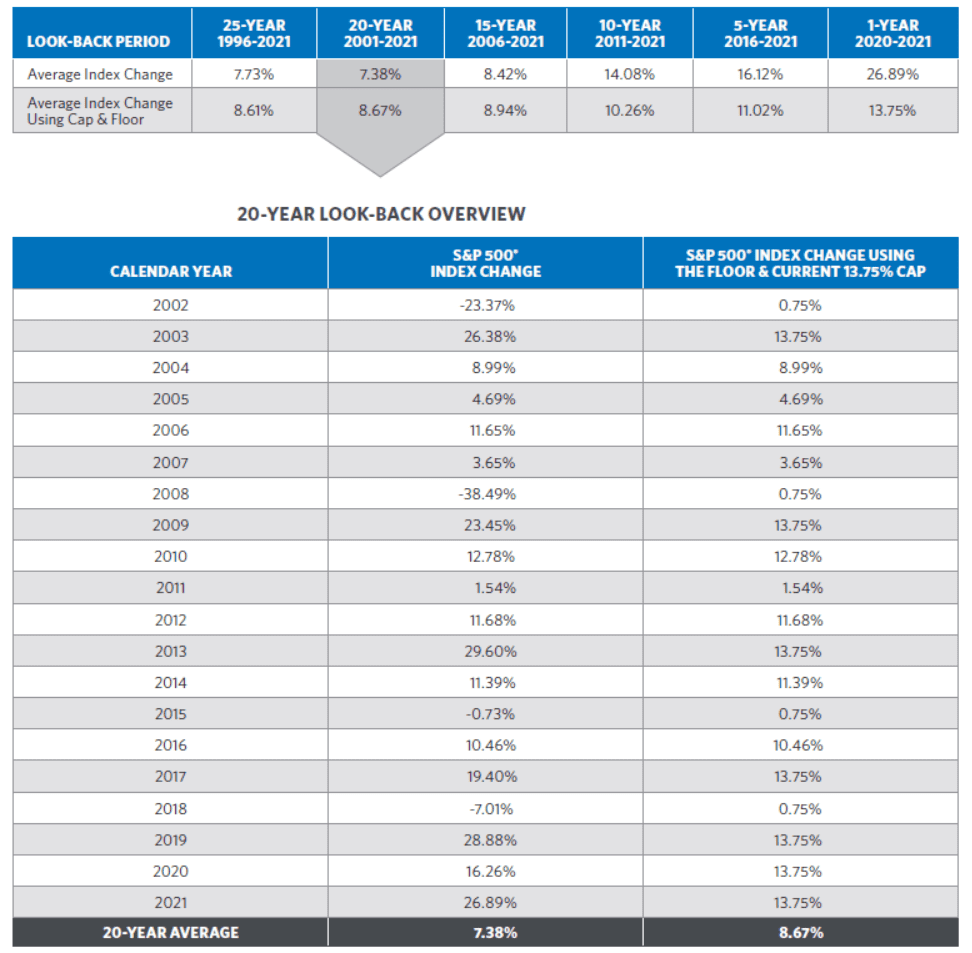

Below see the illustration of one of the IUL products offered by one of many companies out there. Here in this example it shows contributions, accumulation and distributions. John Smith decided to protect his family and also save $500/month for his retirement in IUL type of product, here is how it will look like hypothetically, this is an illustration of $500/month savings into IUL plan with initial $250K protection amount. Here they used 7% hypothetical rate of return, it could be a little bit more or a little bit less , the last 20 years rate of return (market performance) showed more than 7% but in this example they used more conservative number. Below also see the market performance last 20 years. In this example they used Global Index Account (see below) to illustrate this IUL. Please remember that past performance may not be indicative of future results.

GLOBAL INDEX ACCOUNT

The Global Index Account option will never be credited less than the guaranteed minimum interest rate, or “floor,” and has the potential to be credited with Excess Index Interest up to the current cap. The Caps and Floors are subject to change at the discretion of the Company and will be different over different time periods but Floors can't be below 0%. 0.75% Guaranteed minimum interest rate 15% Current cap

S&P 500® INDEX ACCOUNT

The S&P 500® Index Account Option will never be credited less than the guaranteed minimum interest rate, or “floor,” and has the potential to be credited with Excess Index Interest up to the current cap. The Caps and Floors are subject to change at the discretion of the Company and will be different over different time periods but Floors can't be below 0%. 0.75% Guaranteed minimum interest rate 13.75% Current cap

This is just one hypothetical example, for each individual it should be different illustrations tailored to his/her specific needs.

Initial Monthly Premium: The first premium, generally payable with the application or upon delivery of policy. Monthly premium is the monthly payment that you pay your life insurance company in exchange for your life insurance policy coverage (Face Amount), in short for your cost of insurance (COI) and for cash value accumulation if applicable.

Initial Face Amount: An initial amount used to determine the initial death benefit. The policy owner may increase the Face Amount after the first policy anniversary. Decreases available only after the third policy anniversary.

Death Benefit Option: There are two types of death benefit options in life insurance policy, increasing and level.

Increasing: Increasing death benefit option means, upon the death of the insured, the beneficiary receives an initial face amount (initial death benefit) of the life insurance policy plus any accumulated cash value less any loan balance. Assume the owner paid the premium for a $500,000 policy for 15 years, accumulating a cash value of $65,000. The insurance company would pay $500,000 for insurance plus the $65,000 cash value, for a total benefit of $565,000 , assuming there is no loan balance.

Level: Level death benefit option means, upon the death of the insured, the insurance company pays a death benefit consisting of insurance and a return of the policy's cash value less any loan balance. Assume the owner paid the premium for a $500,000 policy for 15 years, accumulating a cash value of $65,000. The insurance company would pay $435,000 for insurance and return the $65,000 cash value, for a total benefit of $500,000 assuming there is no loan balance.

Premium Outlay: The Premium Outlay is the amount of premium which is planned to be paid during the lifetime of this policy. In this case the first year Premium Outlay is $6,000. The amount of premium that may be paid is subject to any applicable limits set by Section 7702 of the Internal Revenue Code.

Policy Value: The policy value is the starting point for calculating important values under the policy, such as the cash surrender value and death benefit. The policy value equals the sum of the basic interest account value, the S&P 500 Index account value and the Global index account value, plus the loan reserve, if any. Policy Value is shown on a guaranteed basis and on non-guaranteed basis.

Cash Surrender Value: The amount available to the owner upon surrender of the policy provided the policy is in force and the insured is living. The cash surrender value equals the policy value less any surrender charges less any loan balance.

Death Benefit: A death benefit is a payout to the beneficiary of a life insurance policy when the insured dies. In this particular case the initial death benefit provided is assumed to be $250,000. The actual amount payable at death may be decreased by policy withdrawals or any loan balance, or increased by additional insurance benefits you purchase death benefit column shows the value, if paid upon death, at the end of the policy year. In this example the life insurance policy provides an increasing death benefit.

This particular policy has 15 years surrender period, means after 15th year there is no surrender charges. There are other companies that have 10 years surrender period. But every year the surrender charges get smaller and smaller and eventually get to $0.00.