Permanent Life Insurance

Permanent Life Insurance

- Death benefit is the amount of money the insurance company guarantees to the beneficiaries identified in the policy upon the death of the insured. The insured will choose their desired death benefit amount based on estimated future needs of surviving heirs. The insurance company will determine whether there is an insurable interest and if the insured qualifies for the coverage based on the company's underwriting requirements.

- Premium payments are set using actuarially based statistics. The insurer will determine the cost of insurance (COI), or the amount required to cover mortality costs, administrative fees and other policy maintenance fees. Other factors that influence the premium are the insured’s age, medical history, occupational hazards and personal risk propensity. The insurer will remain obligated to pay the death benefit if premiums are submitted as required. With term policies, the premium amount includes the cost of insurance (COI). For permanent policies, the premium amount consists of the COI and a cash value amount.

- Cash value of permanent life insurance is a component which serves two purposes. It is a savings account, which can be used by the policyholder, during the life of the insured, with cash accumulated on a tax-deferred basis, the tax-free withdrawals and policy loans can then be borrowed against cash value (See :IRC 7702). Some policies may have restrictions on withdrawals depending on the use of the money withdrawn. The second purpose of the cash value is to offset the rising cost or to provide insurance as the insured ages.

What Is Whole Life Insurance?

How does Whole Life Insurance Work?

Pros & Cons of Whole Life Insurance

Pros

- Permanency

- Predictability

- Tax Breaks

- Potential Loan Collateral

Cons

- Higher Cost

- Smaller Death Benefit

- Lack of investment Control

- Permanency. As long as you keep up with the premiums, a whole life policy can last your entire life. A term policy, on the other hand, is good for a certain number of years, after which you’ll typically have to replace it if you still need insurance. By then you may have more difficulty buying insurance—or getting it an affordable price—due to your age or health issues. However, people whose term policies expire often have more options than they realize for retaining some kind of insurance.

- Predictability. With a whole life policy, your premiums stay the same, as does your death benefit. With either form of variable life insurance you're subject to markets' ups and downs. People who are uncomfortable with investment risk and want a permanent policy may do better with whole life.

ConsTax Breaks. As with the other forms of permanent insurance, the cash value in a whole life policy grows tax deferred. By contrast, if that money were in a regular, non-retirement investment account, its interest and dividends would be taxed every year. What’s more, life insurance proceeds (the death benefit that goes to the beneficiary) are generally not taxable, so those investment gains may escape taxation altogether.Potential Loan Collateral. As mentioned above, policyholders can borrow against the cash value of their policies after a certain point. That could be useful in a financial emergency for someone who has exhausted all other sources for borrowing. And unlike other kinds of loans, they don’t have to pay the money back if they can’t or choose not to. However, there are some major caveats here, one of which is that the policy’s death benefit will be reduced accordingly if they die before paying it back.

Higher Cost. Compared with term life insurance, whole life insurance is costly—between five and 15 times as expensive, by Investopedia’s estimate. One reason is that part of your premium goes to fund that cash value account (so it isn’t entirely wasted). Another is that insurance salespeople typically receive larger commissions for selling whole life policies than term policies, a fact that may also help explain why permanent insurance policies outsell them.Smaller Death Benefits. The corollary to whole life being more expensive is that whatever amount you spend on insurance will buy you a much lower death benefit than you could get with a term policy. So if you need a lot of insurance—as you might if you have a young family dependent on your income—whole life may not come near providing an adequate amount of protection.Lack of Investment Control. With a whole life policy, the insurance company invests the cash value part of your policy in whatever way it chooses. If you’re a capable investor and comfortable taking on some additional risk, you might achieve greater returns by investing that money on your own. That is why consumer advocates have long suggested that people “buy term and invest the difference.” (To make that strategy work, of course, you actually do have to invest the difference and not just spend it on other things.) With a variable policy you have some investment options, but they’re limited to the menu of funds the insurance company makes available to you.

Universal life (UL) insurance is permanent life insurance (lasting the lifetime of the insured) that has an investment savings element and low premiums similar to those of term life insurance. Most UL insurance policies contain a flexible-premium option. but some require a single premium (single lump-sum premium) or fixed premiums (scheduled fixed premiums).

What Is Universal Life?

Universal life insurance is a type of permanent life insurance, which covers you until death, just like a whole life policy. It’s called "universal" because it’s meant to be a product for anyone with any need. High premiums, low premiums, changing coverage — you name it — universal policies are supposed to allow for it.

The cash value account earns interest based on market rates, which can go up or down depending on how the market performs.

How does Universal Life Insurance Works?

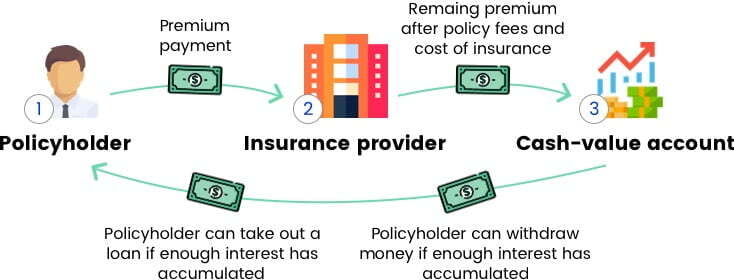

Universal life policies have two main parts. The first is the insurance. This is the part that pays out the death benefit when you die.

The second part is a cash value account. When you make a premium payment, the insurance company takes out the cost of the insurance, as well as any administrative fees, and puts the rest into your cash value account.

Premiums

Universal life policies allow you to pay more than the minimum premium. The remainder goes into your cash account, increasing its value. Alternatively, you can pay less than the minimum premium and draw from your cash account to cover the difference. If you do this, make sure you have enough funds in the account to pay your premiums or else your coverage may lapse.

Death benefit

You have the option to increase — if you qualify — or decrease your death benefit, which can be handy if you no longer need as much coverage, or want more.

One of the biggest decisions you'll make in a universal life policy is how your death benefit is paid out. You have two choices:

Level death benefit: The death benefit remains the same through the life of the policy. For example, if you buy $100,000 of coverage and build up $60,000 in the policy’s cash value account to help pay premiums, your beneficiaries receive $100,000 when you die.

Combined death benefit: Your cash value account is added to the death benefit. So, in the previous example, your beneficiaries would get $160,000 — the death benefit plus the cash value. This option typically requires higher premiums than the first.

Pros & Cons of Universal Life Insurance

Pros

- Flexible premiums

- Flexible death benefit

- Potential cash value growth

Cons

- Increased responsibility

- Increased risk

- Flexible premiums. Universal policies allow you to change the size and frequency of your payments, which can be handy when times are lean. However, underpaying may result in a decrease in coverage, so check with a financial advisor before making any changes.

- Flexible death benefit. You have the option to increase the death benefit if you need more, but you’ll likely need to take a life insurance medical exam to qualify for the extra coverage. If you want to decrease your death benefit, you can typically do so after the policy has been in force for a few years.

- Potential cash value growth. The money in your cash value account will earn interest at the market rate based on the insurer’s general account investments. This means it’s possible to earn more than you would in a whole life policy, which has a flat guaranteed rate.

Increased responsibility. If you don’t pay attention to the value of your account, it may become underfunded, which could leave you with a series of large payments to maintain the coverage you signed up for.Increased risk. Market rates bring volatility. When interest rates are rising, universal life insurance looks like a great product. But if they drop, your cash value account may not perform as you’d hoped. Universal life insurance policies typically come with guaranteed minimum interest rates, so they won’t drop below a certain amount if the market crashes.

Indexed universal life insurance is a type of permanent life insurance, which means it has a cash value component in addition to a death benefit. The money in your cash value account can earn interest based on a stock market index chosen by your insurer, such as the S&P 500 or the Nasdaq Composite or other stock market index. Funds don't earn a fixed rate of interest but typically come with an interest rate guarantee.

What Is Indexed Universal Life?

How does Indexed Universal Life Insurance Work?

When you buy indexed universal life insurance policy, your insurer will help you select the index to use for the cash-value account, part of your policy, and your death benefit. When a premium is paid on the account, a portion pays the cost of insurance (COI) based on the insured's life. Any fees are paid, and the rest is added to the cash value.

The total cash value is credited with interest based on increases in an equity (stock market) index (but it is not directly invested in the stock market). If you own an indexed universal life policy, you can likely borrow against the cash value accused in the policy. However, if you do not pay back your loans, they are deducted from the death benefit.

Some policies allow the policyholder to select multiple indexes. IULs usually offer a guaranteed minimum fixed interest rate and a choice of indexes. Policyholders can decide the percentage allocated to the fixed and indexed accounts. The selected index value is recorded at the beginning of the month and compared with the value at the end of the month. If the index increases during the month, the interest is added to the cash value. The index gains are credited back to the policy either on a monthly or an annual basis.

Let's discuss how Index Universal Life and Indexing strategy work on an example.

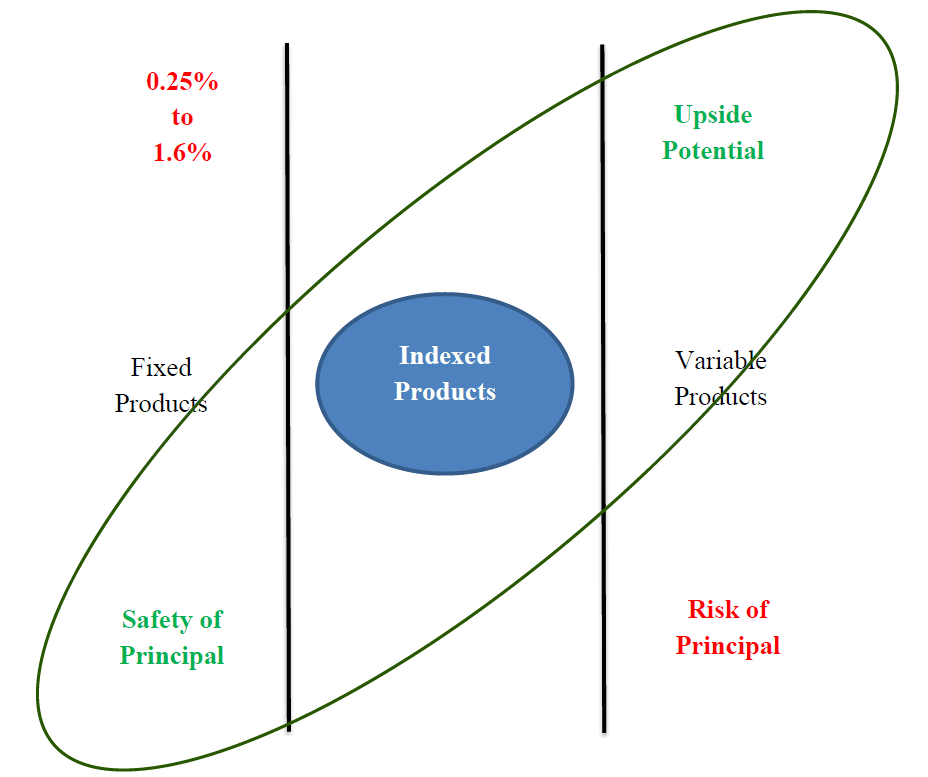

1. Fixed Products

2. Variable Products

But there are Strategies today that give you the Best of both Worlds Safety with Upside Potential

There are strategies today that can minimize or even eliminate some of the risks that we previously talked about. And one of them is indexed products, which give you the best of both worlds. Safety of the principal and also upside potential. Let’s talk how indexing works.

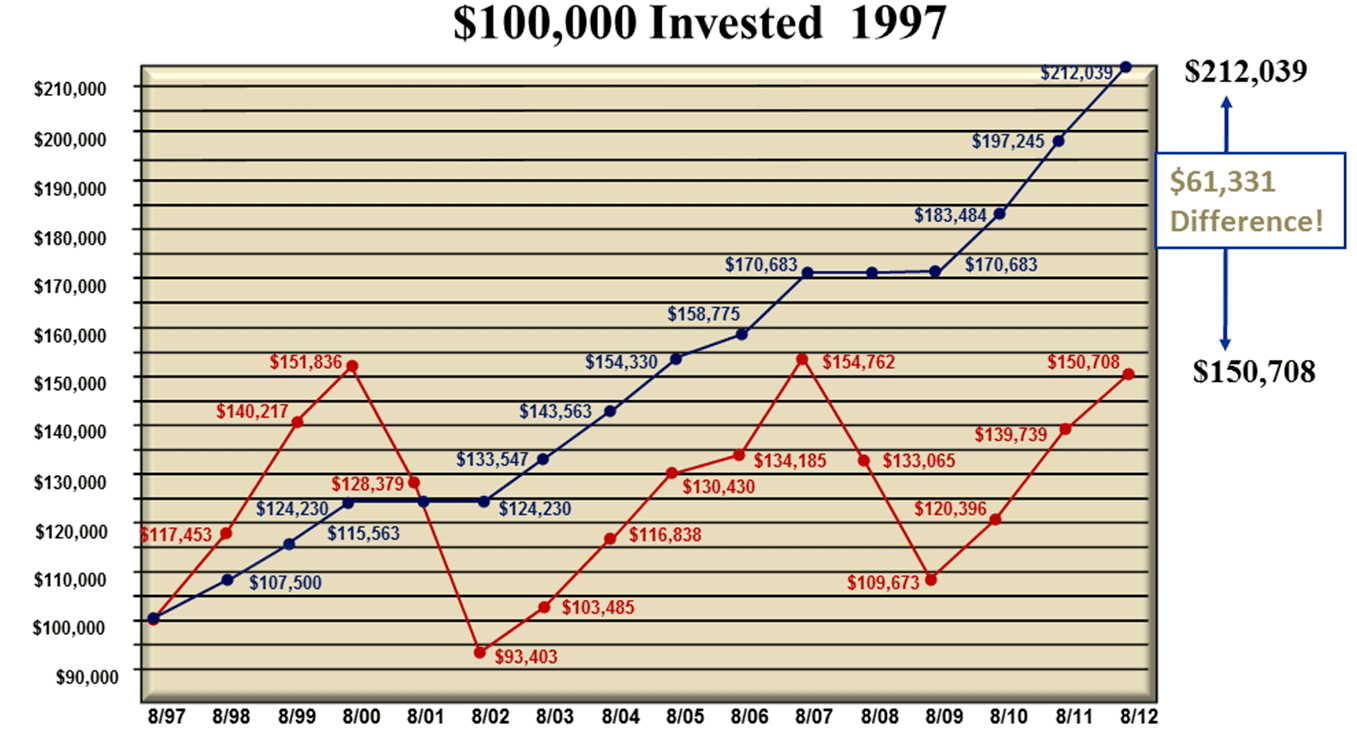

Let’s say you had 100K invested in 1997 for 15 years. This red line is your money in the market (Stock Market). After all these ups and downs and after those 15 years you’ve made about 50 thousand dollars. Blue Line represents the indexed products. Now how the indexing works, first of all your money is not in the market. They just mirror the market (S&P 500, NASDAQ, EURO STOXX 50 Etc.) up to a certain Cap* and there is also floor which is 0% guaranteed but it also could be higher than 0%. So you can see it goes up a little slower because the growth is capped but then you can see when the market drops you just stay right there because of floor (principal protection). POINT WITH LASER TO FIRST DROP. And then when the market picks up again you pick up where you left off vs. everybody else that has to dig themselves out of 36% hole. So the difference in those 15 years 61 thousand dollars. Can anyone use an extra 61K for retirement? We thought so. Okay, so what are your potential options?

*Cap is the maximum percentage that insurance companies can credit to your account.

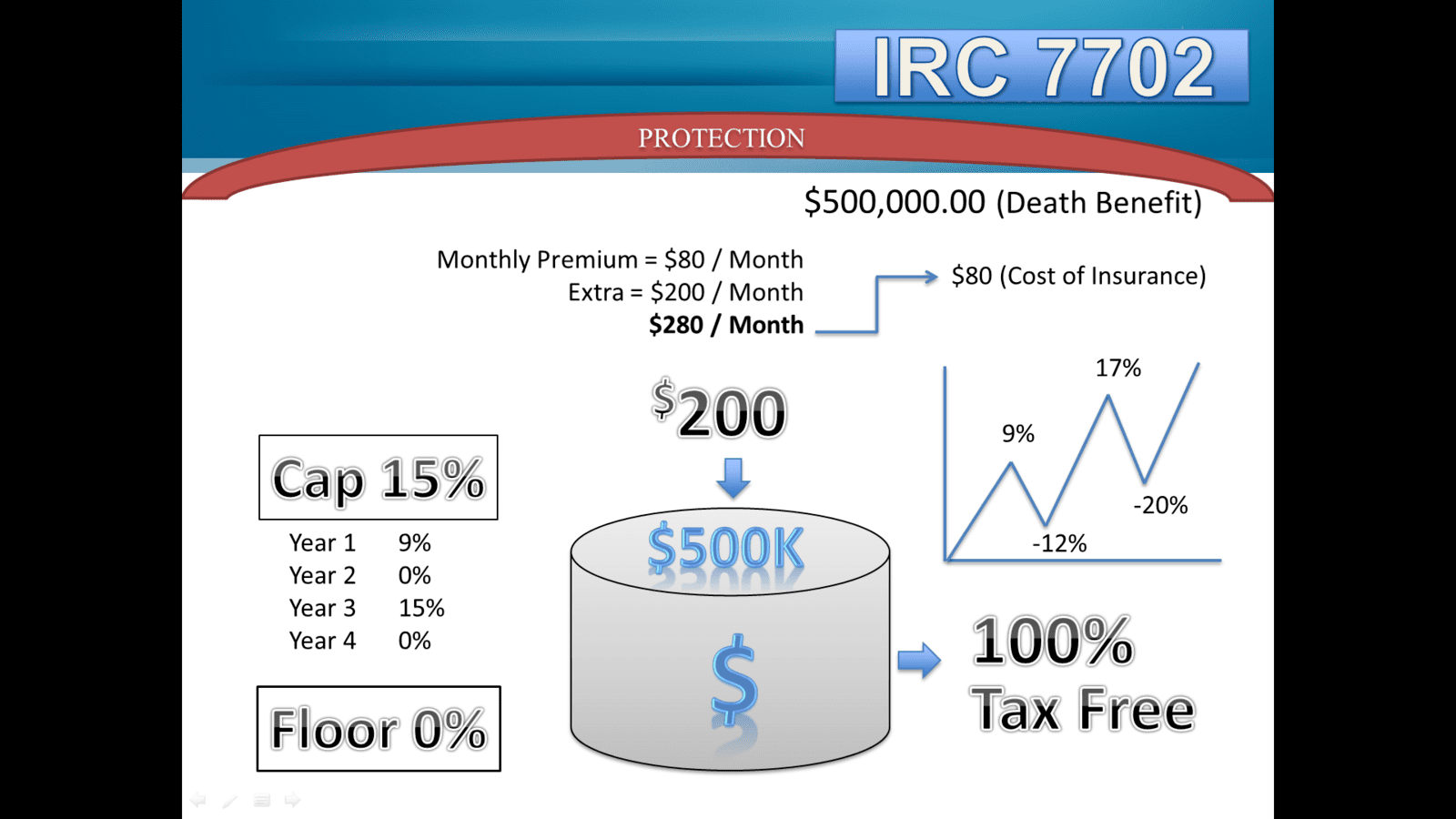

Let's discuss the Indexing and how it works. Let's assume the client bought the protection (life insurance) for his/her family and let's say the initial face amount (death benefit) was $500K and let's assume the coast of insurance (COI) is $80/month (it could vary by policy based on the underwriting factors of Insured, policy administrative and maintenance fees), besides that $80 COI the client decides to send additional $200/month to insurance company, for them to save them into a savings account attached to the life insurance policy where he/she can earn interest on that money based on market performance but the mean time be protected from market downturns (declines) because money in that savings account are not directly invested in the market. Money in that savings account will grow based on market performance but the client can never lose money because there is a floor (principal protection) which can't be below 0% (could be higher then 0%) and they will earn interest based on market performance up to certain Cap in this example the Cap is 15%. Let's say the first year market goes up 9% then in this example the client will earn the whole 9% that year , now let's assume market goes down the next year negative -12% that year the client doesn't earn any interest but what is the most important he/she doesn't lose any money in his/her account the first year gains were locked in, then the following year market recovers up to positive 17% that year the client earns 15% interest because that was his/her Cap in this example and so on and so forth.

This strategy called INDEXING.

Different companies have different Caps and floors but the idea is the same, they provide principal protection (guaranteed floor) with upside potential up to a Cap. Caps can change but insurance companies keep them competitive. Floors can change but they never can go below 0%. This is a hypothetical example for illustration purposes only. Contact financial professional to discuss your specific financial situation and see if an IUL could be a right fit for you.

What is Section 7702? of the U.S. Internal Revenue Code defines what the federal government considers to be a legitimate life insurance contract and determines how such contracts are to be taxed. It applies to life insurance contracts issued after 1985. Section 7702 of the U.S. Internal Revenue Code defines what the federal government considers to be a legitimate life insurance contract and determines how such contracts are to be taxed. It applies to life insurance contracts issued after 1985.

Understanding Section 7702 Prior to the adoption of Section 7702, federal tax law took a fairly hands-off approach when it came to the taxation of life insurance policies. Death benefits paid to life insurance beneficiaries were free from income tax, and any gains that built up within the policy during the policyholder's lifetime were not taxed as part of their income. Aside from the insurance industry's formidable lobbying power, the reasoning behind this favorable tax treatment was that the government did not want to be seen taxing needy beneficiaries—typically widows and children—which would not go over well politically. Life insurance policies that fail to pass the tests in Section 7702 lose any potential tax benefits. Section 7702 was created to differentiate between genuine life insurance policies and investment vehicles masquerading as them and to make sure that only proper policies received the advantageous tax treatment traditionally accorded life insurance.

Under Section 7702, life insurance contracts have to pass one of two tests: the cash value accumulation test (CVAT) or the guideline premium and corridor test (GPT).

- The cash value accumulation test stipulates that the cash surrender value of the contract "may not at any time exceed the net single premium which would have to be paid at such time to fund future benefits under the contract." That basically means that the amount of money the policyholder could get out of the policy if they were to cancel it (often thought of as the "savings" component of cash value life insurance) can't be greater than what the policyholder have paid to purchase the policy with a single lump sum, not including any fees.

- The guideline premium and corridor test requires that "the sum of the premiums paid under such contract does not at any time exceed the guideline premium limitation as of such time." That basically means that the policyholder can't have paid more into the policy than would be necessary to fund its insurance benefits.

What happens if a life insurance contract fails to pass either of those tests? Life insurance contract become a MEC (Modified Endowment Contract) and section 7702(g) stipulates that the "income on the contract" will be treated as ordinary income to the policyholder for that year and taxed accordingly. In other words, it will lose the favorable tax treatment of a true life insurance policy.

In this content, word Market means Stock Market, There are many different stock markets and stock market indexes in the US and other countries around a world, also, market performance means Stock market Index performance. Here are some examples of Stock Market Indexes:

S&P 500: The Standard and Poor's 500, or simply the S&P 500, is a stock market index made up of 500 large companies listed on stock exchanges in the United States, tracking the performance of large-cap stocks.

NASDAQ: Also used to refer to the Nasdaq Composite is a stock market index that includes almost all stocks listed on the Nasdaq stock exchange,

an index of more than 3,700 stocks listed on the Nasdaq exchange that includes technology giants Apple Inc. (AAPL), Microsoft (MSFT), Google parent Alphabet (GOOG, GOOGL), Meta Platforms Inc. (META), Amazon.com Inc. (AMZN) and Tesla Inc. (TSLA).

Dow Jones Industrial Average: The Dow Jones Industrial Average, Dow Jones, or simply the Dow, is a price-weighted measurement stock market index of 30 prominent companies listed on stock exchanges in the United States.

EURO STOXX 50: The EURO STOXX 50 is a stock index of Eurozone stocks designed by STOXX, an index provider owned by Deutsche Börse Group. As of April 2021, the index was dominated by France and Germany. According to STOXX, its goal is "to provide a blue-chip representation of Supersector leaders in the Eurozone".

Hang Seng Index: The Hang Seng Index is a free float-adjusted market-capitalization-weighted stock-market index in Hong Kong. It is used to record and monitor daily changes of the largest companies of the Hong Kong stock market and is the main indicator of the overall market performance in Hong Kong.

Go to Solutions to download the app and find out how much you might need at the time of your retirement and how much you should save to meet those financial goals.

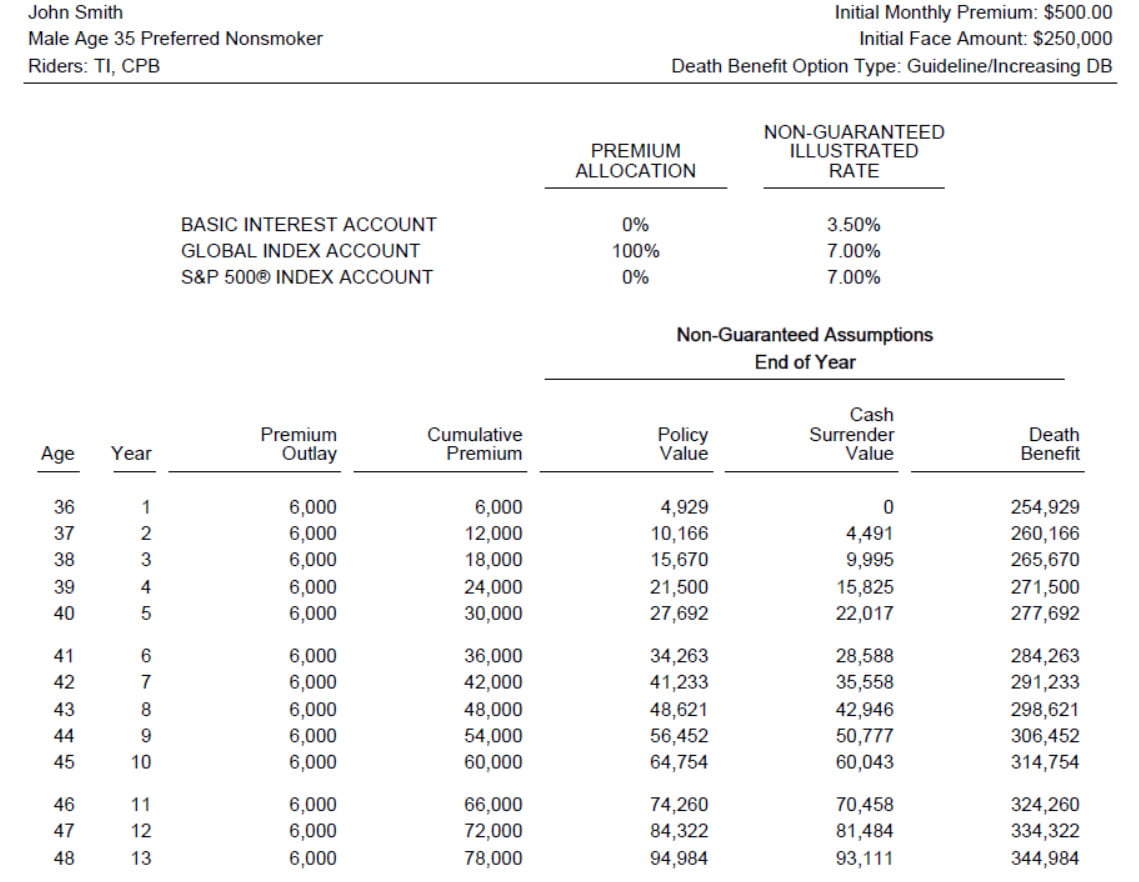

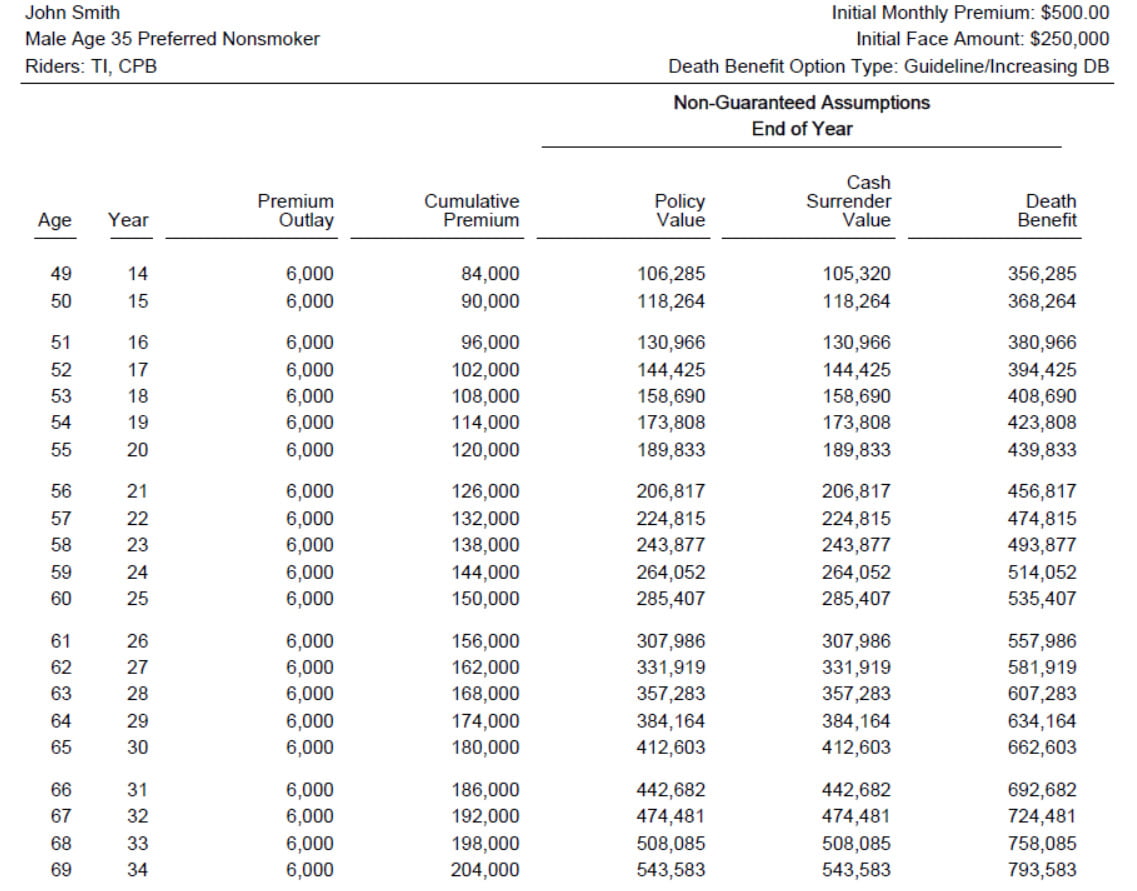

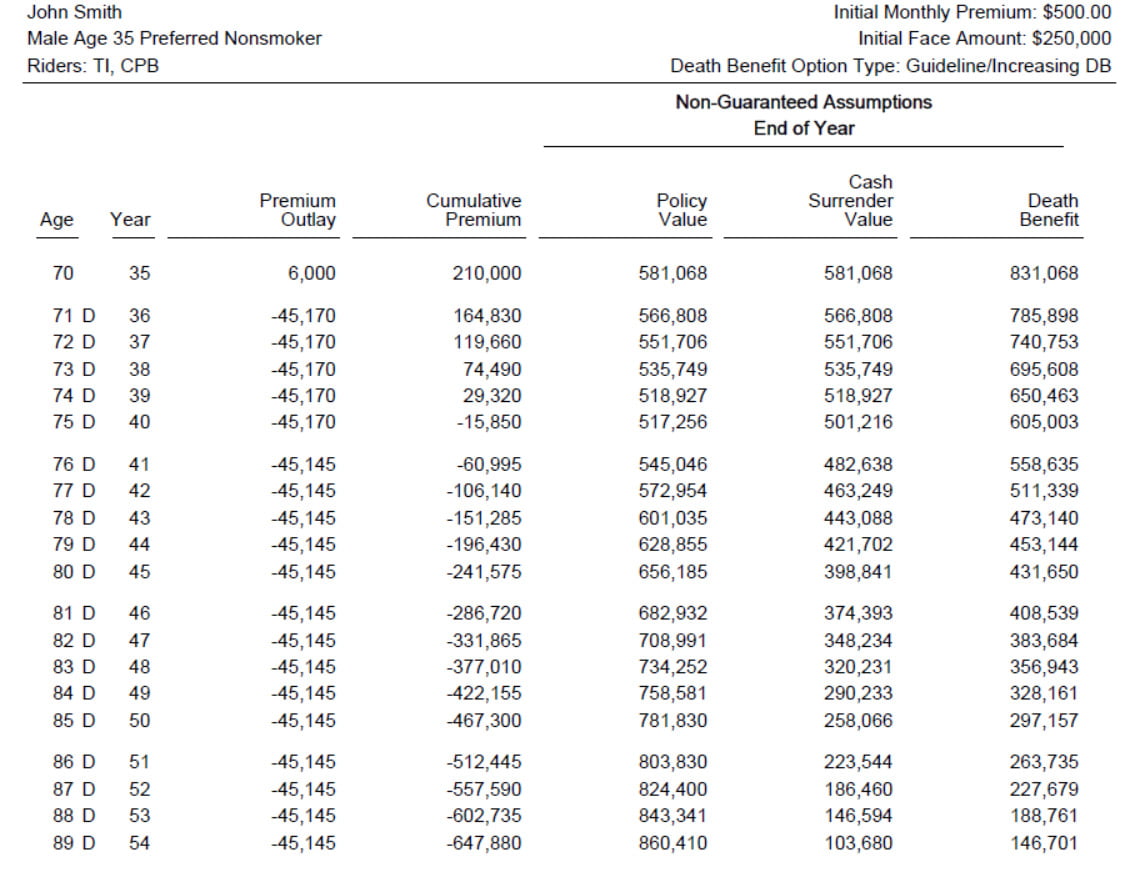

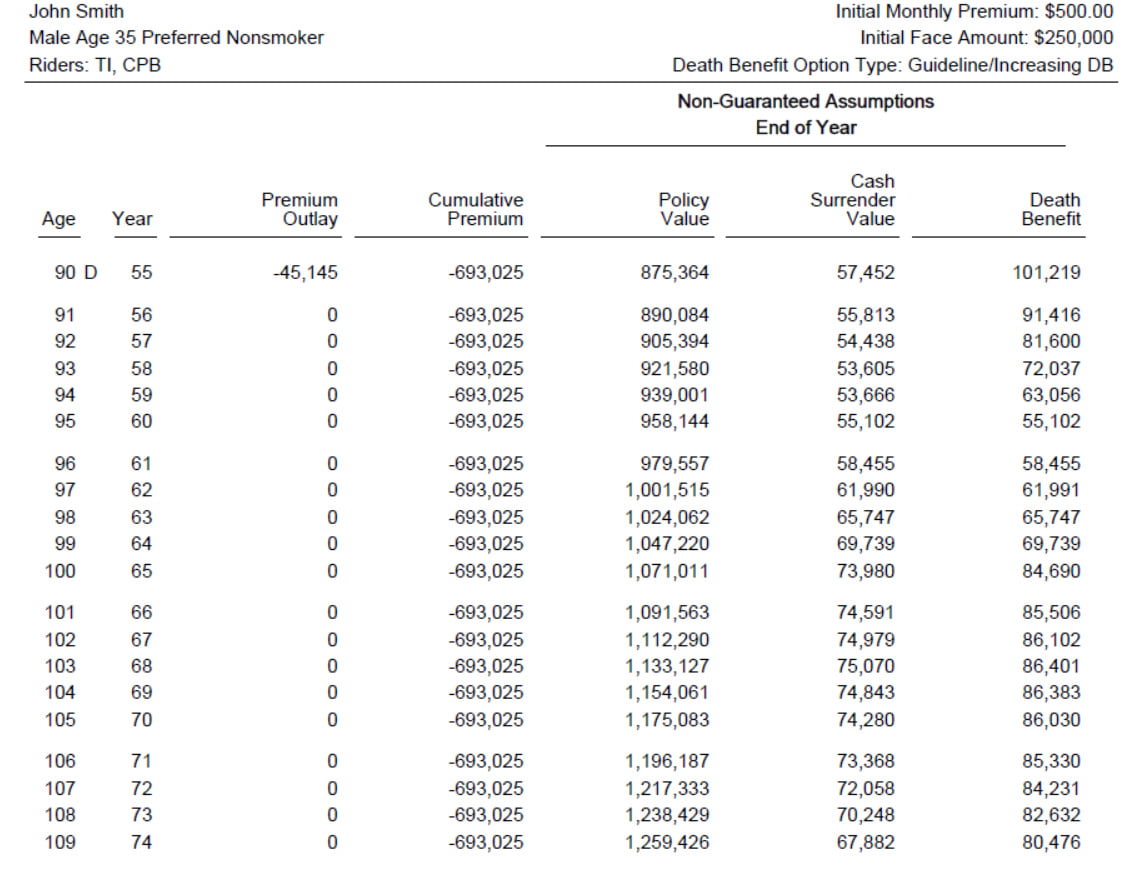

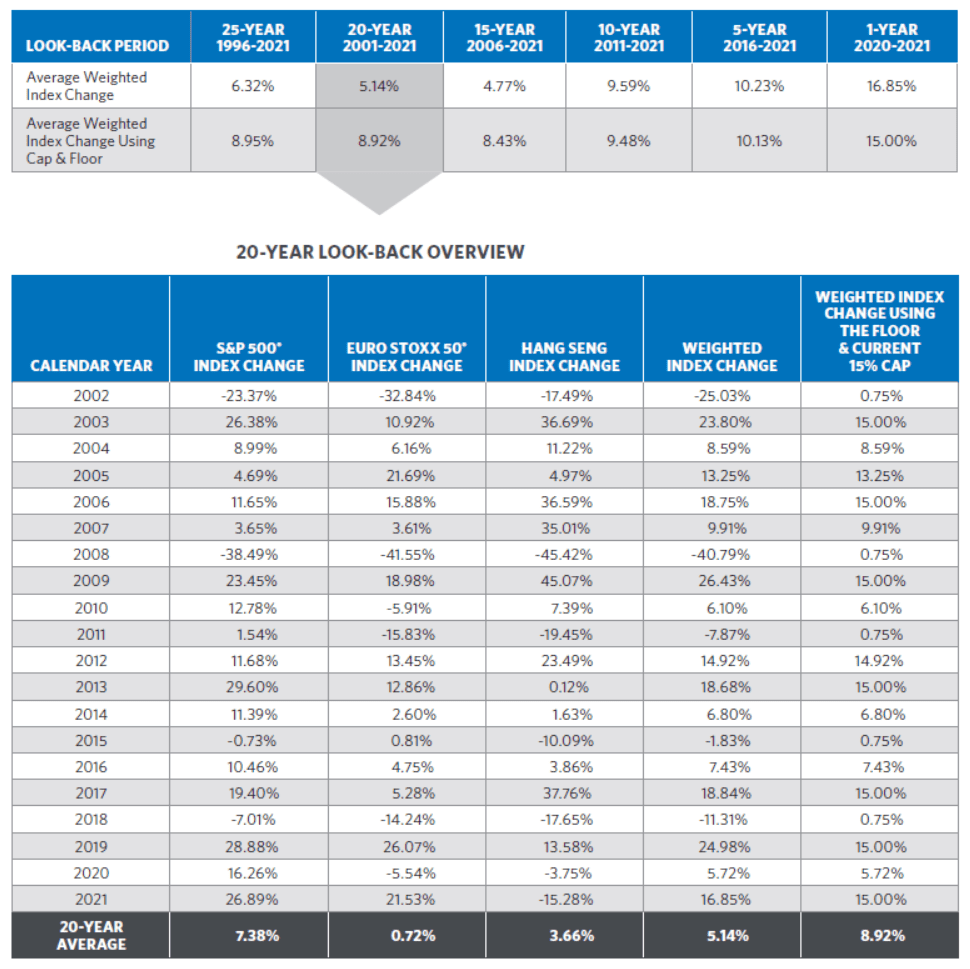

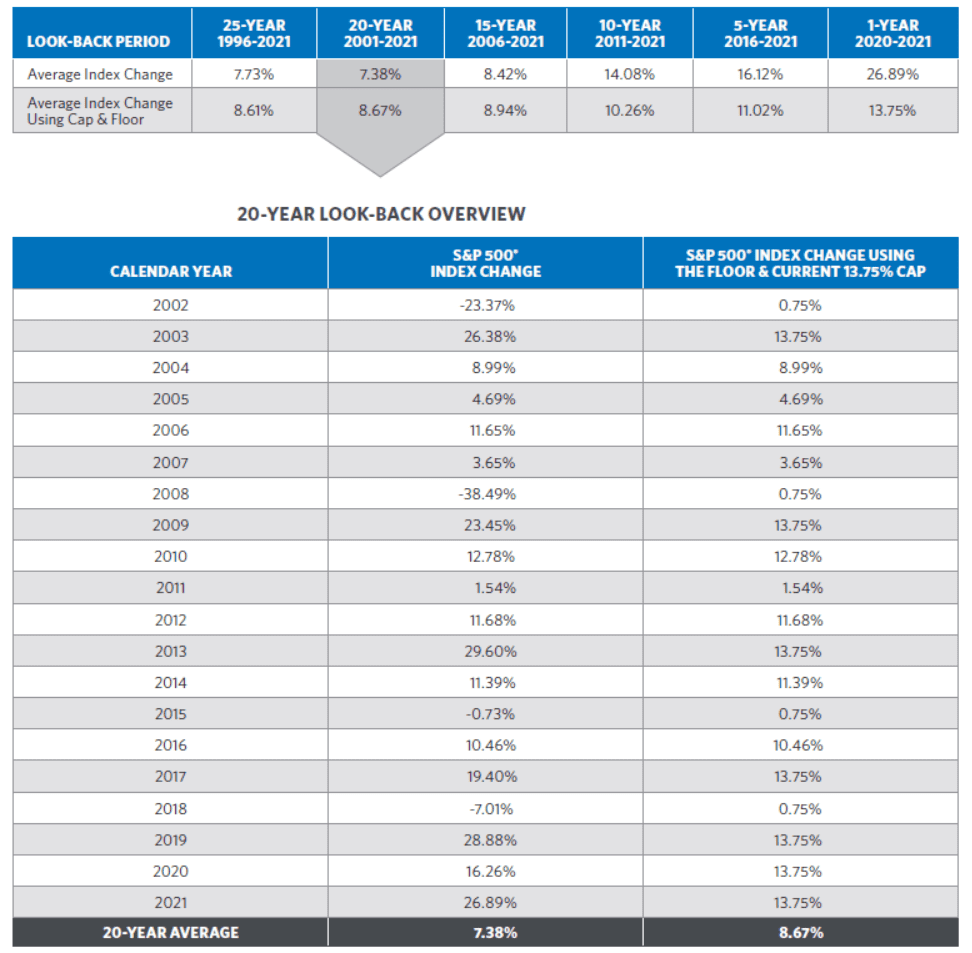

Below see the illustration of one of the IUL products offered by one of many companies out there. Here in this example it shows contributions, accumulation and distributions. John Smith decided to protect his family and also save $500/month for his retirement in IUL type of product, here is how it will look like hypothetically, this is an illustration of $500/month savings into IUL plan with initial $250K protection amount. Here they used 7% hypothetical rate of return, it could be a little bit more or a little bit less , the last 20 years rate of return (market performance) showed more than 7% but in this example they used more conservative number. Below also see the market performance last 20 years. In this example they used Global Index Account (see below) to illustrate this IUL. Please remember that past performance may not be indicative of future results.

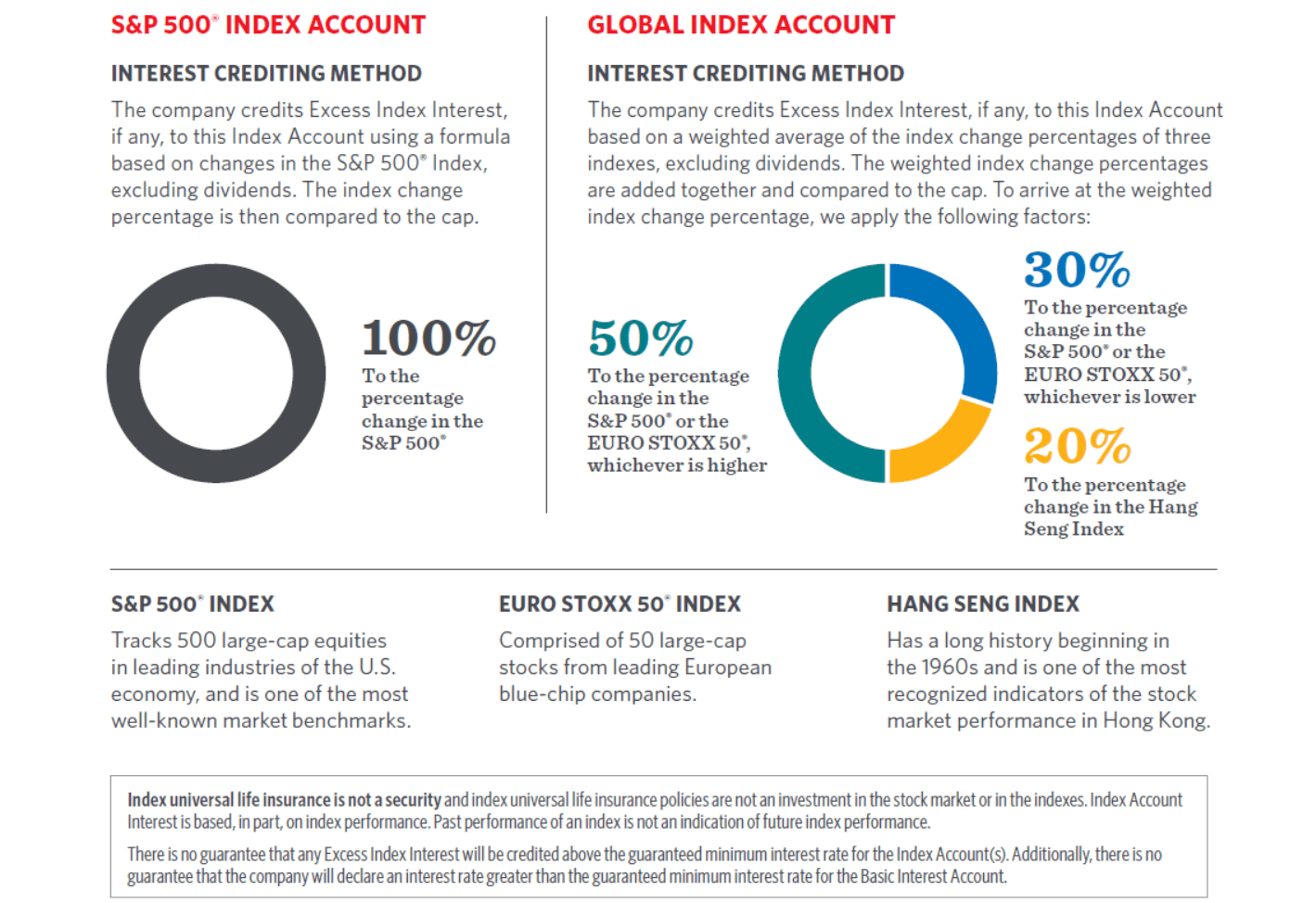

GLOBAL INDEX ACCOUNT

The Global Index Account option will never be credited less than the guaranteed minimum interest rate, or “floor,” and has the potential to be credited with Excess Index Interest up to the current cap. The Caps and Floors are subject to change at the discretion of the Company and will be different over different time periods but Floors can't be below 0%. 0.75% Guaranteed minimum interest rate 15% Current cap

S&P 500® INDEX ACCOUNT

The S&P 500® Index Account Option will never be credited less than the guaranteed minimum interest rate, or “floor,” and has the potential to be credited with Excess Index Interest up to the current cap. The Caps and Floors are subject to change at the discretion of the Company and will be different over different time periods but Floors can't be below 0%. 0.75% Guaranteed minimum interest rate 13.75% Current cap

This is just one hypothetical example, for each individual it should be different illustrations tailored to his/her specific needs.

Initial Monthly Premium: The first premium, generally payable with the application or upon delivery of policy. Monthly premium is the monthly payment that you pay your life insurance company in exchange for your life insurance policy coverage (Face Amount), in short for your cost of insurance (COI) and for cash value accumulation if applicable.

Initial Face Amount: An initial amount used to determine the initial death benefit. The policy owner may increase the Face Amount after the first policy anniversary. Decreases available only after the third policy anniversary.

Death Benefit Option: There are two types of death benefit options in life insurance policy, increasing and level.

Increasing: Increasing death benefit option means, upon the death of the insured, the beneficiary receives an initial face amount (initial death benefit) of the life insurance policy plus any accumulated cash value less any loan balance. Assume the owner paid the premium for a $500,000 policy for 15 years, accumulating a cash value of $65,000. The insurance company would pay $500,000 for insurance plus the $65,000 cash value, for a total benefit of $565,000 , assuming there is no loan balance.

Level: Level death benefit option means, upon the death of the insured, the insurance company pays a death benefit consisting of insurance and a return of the policy's cash value less any loan balance. Assume the owner paid the premium for a $500,000 policy for 15 years, accumulating a cash value of $65,000. The insurance company would pay $435,000 for insurance and return the $65,000 cash value, for a total benefit of $500,000 assuming there is no loan balance.

Premium Outlay: The Premium Outlay is the amount of premium which is planned to be paid during the lifetime of this policy. In this case the first year Premium Outlay is $6,000. The amount of premium that may be paid is subject to any applicable limits set by Section 7702 of the Internal Revenue Code.

Policy Value: The policy value is the starting point for calculating important values under the policy, such as the cash surrender value and death benefit. The policy value equals the sum of the basic interest account value, the S&P 500 Index account value and the Global index account value, plus the loan reserve, if any. Policy Value is shown on a guaranteed basis and on non-guaranteed basis.

Cash Surrender Value: The amount available to the owner upon surrender of the policy provided the policy is in force and the insured is living. The cash surrender value equals the policy value less any surrender charges less any loan balance.

Death Benefit: A death benefit is a payout to the beneficiary of a life insurance policy when the insured dies. In this particular case the initial death benefit provided is assumed to be $250,000. The actual amount payable at death may be decreased by policy withdrawals or any loan balance, or increased by additional insurance benefits you purchase death benefit column shows the value, if paid upon death, at the end of the policy year. In this example the life insurance policy provides an increasing death benefit.

This particular policy has 15 years surrender period, means after 15th year there is no surrender charges. There are other companies that have 10 years surrender period. But every year the surrender charges get smaller and smaller and eventually get to $0.00.

Pros & Cons of Indexed Universal Life Insurance

Pros

- Higher Return Potential

- Greater Flexibility

- Tax-Free Capital Gains

- No Social Security Impact

- Death Benefit

Cons

- Caps on Returns

- No Guarantees

- Fees

Higher Return Potential. These policies leverage call options to gain upside exposure to equity indexes without the risk of losses, while whole life insurance policies and fixed universal life insurance policies provide only a small interest rate that may not even be guaranteed. Of course, the annual return that you see with an IUL insurance policy will depend on how well its underlying index performs. But your insurance company can still offer a guaranteed minimum return on your investment.Greater Flexibility. IUL insurance can offer flexibility when putting together a policy that’s designed to meet your investment goals. Policyholders can decide how much risk they would like to take in the market, adjust death benefit amounts as needed, and choose among a number of riders that make the policy customizable to their needs. For example, you may choose to add on a long-term care rider to cover nursing home costs if that becomes necessary.

ConsTax Free Capital Gains. Policyholders do not pay capital gains on the increase in cash value over time unless they abandon the policy before it matures, whereas other types of financial accounts may tax capital gains upon withdrawal.1 This benefit extends to any loans that you may take from the policy against your cash value. Having a ready source of cash that you can borrow against may be appealing if you want to avoid triggering taxes and penalties with an early withdrawal from a 401(k) or IRA.No Social Security Impact. Social Security benefits may be an important source of income in retirement. You can begin taking Social Security as early as age 62 or defer benefits up to age 70. Taking benefits ahead of your full retirement age can shrink your benefit amount, as can working while receiving benefits. You’re only allowed to earn so much per year prior to reaching full retirement age before your benefits are reduced.Cash value accumulation from an IUL insurance policy wouldn’t count toward the earnings thresholds, nor would any loan amounts that you borrow. So you could take a loan against your policy to supplement Social Security benefits without detracting from your benefit amount.Death Benefit. IUL insurance, like other types of life insurance, can provide a death benefit for your loved ones. This money can be used to pay funeral and burial expenses, cover outstanding debts such as a mortgage or co-signed student loans, fund college costs for children, or simply pay for everyday living expenses. This death benefit can be passed on to your beneficiaries tax-free.

Caps on Returns. Insurance companies often set maximum participation rates of less than 100% and as low as 25% in some cases. In addition, returns on equity indexes are often capped at certain amounts during good years. These restrictions can limit the actual rate of return that’s credited toward your account each year, regardless of how well the policy’s underlying index performs.In that case, you may be better off investing in the market directly or considering a variable universal life insurance policy instead. But it’s important to consider your personal risk tolerance and investment goals to ensure that either one aligns with your overall strategy.No Guarantees. Whole life insurance policies often include a guaranteed interest rate with predictable premium amounts throughout the life of the policy. IUL policies, on the other hand, offer returns based on an index and have variable premiums over time. This means that you have to be comfortable riding out fluctuations in returns while also budgeting for potentially higher premiums.Fees. IUL insurance policies can come with a slew of fees and other costs, including:

- Premium expense charges

- Administrative expenses (Policy Fee)

- Index account monthly charge (IMAC)

- Riders (If applicable)

- Fees and commissions

- Surrender charge (usually between first 10 to 15 years of the policy)

All of these fees and various costs can detract from the rate of return offered by your policy. That’s why it’s important to research the best life insurance companies so you understand what you’re paying for in coverage and getting in return.