Long-Term Financial Planning

INTRUDOCTION

Long-Term Financial Planning

INTRUDOCTION

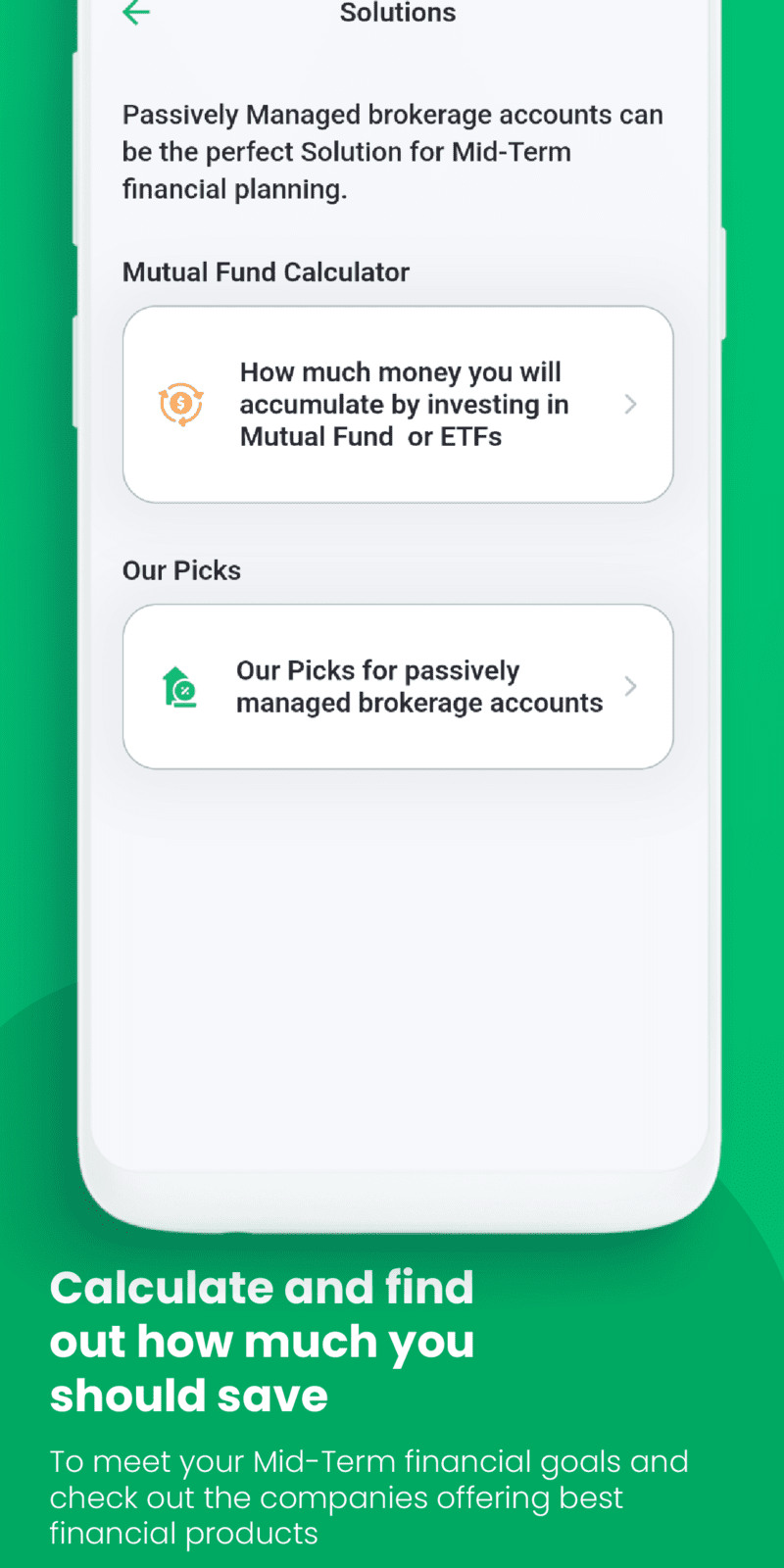

Passively Managed brokerage accounts can be the perfect solution for mid-term financial planning.

Mutual Fund Calculator

Download the App go to Mid-Term planning/Solutions and calculate "How much money you will accumulate" by investing in Mutual Fund or ETFs for Mid-Term financial planning.

How To Use the Calculator

- Enter an initial investment amount.

- Next, enter an annual contribution if you plan (as experts advise) to make regular new investments. Many mutual funds have minimum initial investments, but brokers often will waive that minimum if you make monthly deposits.

- Add how many years you plan to stay invested in the fund. The longer the time horizon, the greater the potential returns.

- Input an estimated annual return for the mutual fund. (You can find the fund's historical performance online, but remember — past performance does not guarantee future results.)

- Finally, add the annual fees, known as the mutual fund's expense ratio. Lower fees means more of your cash will stay invested for potential long-term growth.

Our Picks

These three are among our picks for Managed Brokerage Account Providers (Brokers) These providers are especially notable for baing low on fees

Managed Brokerage Accounts

Managed Brokerage Accounts