Term Life Insurance

Term Life Insurance

Level Term, or Level-Premium, Policies

These provide coverage for a specified period ranging from 10 to 30 years. Both the death benefit and premium are fixed. Because actuaries must account for the increasing costs of insurance over the life of the policy's effectiveness, the premium is comparatively higher than yearly renewable term life insurance.

What Is Level Term (Level-Premium) Insurance?

Level-premium insurance is a type of permanent or term life insurance where the premium remains the same over the policy's life. With this type of coverage, premiums are thus guaranteed to remain the same throughout the contract. For a permanent insurance policy like whole life, the amount of coverage provided increases over time.

As a result, the coverage can be advantageous over a long period of time: a policyholder keeps paying the same amount but has access to increased death benefit coverage as the policy matures.

Term policies are also often level-premium, but the overage amount will remain the same and not grow. The most common terms are 10, 15, 20, and 30 years, based on the needs of the policyholder.

How Does Level Term Insurance Work?

Level-premium insurance premiums are fixed for the life of the policy. For a term policy, this means for the length of the term (e.g. 20 or 30 years); and for a permanent policy, until the insured passes away.

Cost of Premiums

Level-premium policies will typically cost more up-front than annually-renewing insurance policies with terms of only one year at a time. But over the long run, level-premium payments are often more cost-effective. This is because the higher premiums have typically been offset by an increase in coverage during a period when a policyholder typically has more medical issues.

Ages and Stages

The amount of level premium paid on a policy will depend on one's age and health: the younger and healthier one is, the lower the level premium will be. For term life policies, the length of the term will also matter: longer-dated policies will cost more per month than shorter policies. The length of a term policy will often be selected to best suit one's specific needs.

For example, if the primary purpose of the death benefit is to provide income to support very young children and fund college expenses, a 20-year level-premium might be appropriate. However, if these children are already in their early teens, a 10-year level premium may be sufficient. If the insured is the same age, the 10-year term policy would cost less, all else equal, than the 20-year policy's premiums.

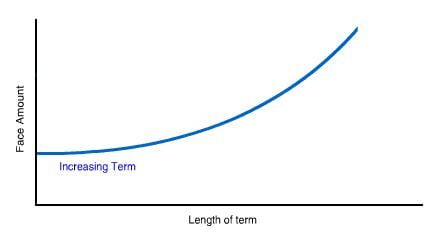

Increasing Term Policies

Increasing term life insurance policies feature a death benefit that grows over time. These products are designed for people who know they need coverage now but also want more coverage in the future. Your monthly premiums may also increase over time.

What is Increasing Term Life Insurance?

Increasing term is a type of term life insurance, which means it lasts for a specific period, such as 10, 20 or 30 years.

If you die during this time, your beneficiary receives a death benefit from the life insurance company. If you die after the term, your beneficiary receives nothing. Most term life policies are level, meaning your premiums are stable and the death benefit does not change.

However, the death benefit for increasing term policies get larger over time. This can help offset inflation or protect your growing family.

While your death benefit increases, your premiums may or may not increase as well.

Increasing term life policies are less common in the U.S. than other forms of term life insurance. They also tend to cost more than a level term policy because the potential payout gets larger over time.

How does Increasing Term Insurance Works?

These policies have a death benefit that declines each year, according to a predetermined schedule. The policyholder pays a fixed, level premium for the duration of the policy. Decreasing term policies are often used in concert with a mortgage to match the coverage with the declining principal of the home loan.

Once you've picked the policy that's right for you, remember to research the firms you're considering thoroughly to ensure you'll get the best term life insurance available.

What Is Decreasing Term Insurance?

Decreasing term insurance is a type of renewable term life insurance with coverage decreasing over the life of the policy at a predetermined rate. Premiums are usually constant throughout the contract, and reductions in coverage typically occur monthly or annually. Terms range between 1 year and 30 years depending on the plan offered by the insurance company.

Decreasing term life insurance is usually used to guarantee the remaining balance of an amortizing loan, such as a mortgage or business loan over time. It can be contrasted with level-premium term insurance.

How Does Decreasing Term Insurance Works?

Decreasing term insurance is a type of renewable term life insurance with coverage decreasing over the life of the policy at a predetermined rate. Premiums are usually constant throughout the contract, and reductions in coverage typically occur monthly or annually. Terms range between 1 year and 30 years depending on the plan offered by the insurance company.

Decreasing term life insurance is usually used to guarantee the remaining balance of an amortizing loan, such as a mortgage or business loan over time. It can be contrasted with level-premium term insurance.

How Does Decreasing Term Insurance Works?

Term life insurance is a form of coverage that provides a death benefit for only a certain length of time. For instance, a 20-year term life insurance policy would feature level premiums and the same death benefit over the course of its term. Decreasing term insurance instead features a declining death benefit over time, along with decreasing premiums. These amounts will be set to a schedule when the policy is purchased and may conform to a standard schedule or be customized between the insurer and the insured.

The theory behind decreasing term insurance holds that with age, certain liabilities, and the corresponding need for high levels of insurance decreases. Numerous in-force decreasing term insurance policies take the form of mortgage life insurance, which affixes its benefit to the remaining mortgage of an insured’s home.

Alone, decreasing term insurance may not be sufficient for an individual's life insurance needs, especially if they have a family with dependents. Affordable standard term life insurance policies offer the security of a death benefit throughout the life of the contract.

IMPORTANT: The payment structure is the primary way this type of insurance is different from regular term life. The amount in the death benefit goes down, unlike other forms of life insurance.

Benefits of Decreasing Term Life Insurance

The predominant use of decreasing term insurance is most often for personal asset protection. Small business partnerships also use a decreasing term life policy to protect indebtedness against startup costs and operational expenses.

In the case of small businesses, if one partner dies, the death benefit proceeds from the decreasing term policy can help to fund continuing operations or retire the percentage of the remaining debt for which the deceased partner is responsible. The security allows the business to guarantee commercial loan amounts affordably.

Decreasing term insurance is a more affordable option than whole life or universal life insurance. The death benefit is designed to mirror the amortization schedule of a mortgage or other personal debt not easily covered by personal assets or income, like personal loans or business loans.

Decreasing term insurance allows a pure death benefit with no cash accumulation, unlike, for example, a whole life insurance policy. As such, this insurance option has modest premiums for comparable benefit amounts to either a permanent or temporary life insurance.

Term life insurance is a form of coverage that provides a death benefit for only a certain length of time. For instance, a 20-year term life insurance policy would feature level premiums and the same death benefit over the course of its term. Decreasing term insurance instead features a declining death benefit over time, along with decreasing premiums. These amounts will be set to a schedule when the policy is purchased and may conform to a standard schedule or be customized between the insurer and the insured.

The theory behind decreasing term insurance holds that with age, certain liabilities, and the corresponding need for high levels of insurance decreases. Numerous in-force decreasing term insurance policies take the form of mortgage life insurance, which affixes its benefit to the remaining mortgage of an insured’s home.

Alone, decreasing term insurance may not be sufficient for an individual's life insurance needs, especially if they have a family with dependents. Affordable standard term life insurance policies offer the security of a death benefit throughout the life of the contract.

IMPORTANT: The payment structure is the primary way this type of insurance is different from regular term life. The amount in the death benefit goes down, unlike other forms of life insurance.

Benefits of Decreasing Term Life Insurance

The predominant use of decreasing term insurance is most often for personal asset protection. Small business partnerships also use a decreasing term life policy to protect indebtedness against startup costs and operational expenses.

In the case of small businesses, if one partner dies, the death benefit proceeds from the decreasing term policy can help to fund continuing operations or retire the percentage of the remaining debt for which the deceased partner is responsible. The security allows the business to guarantee commercial loan amounts affordably.

Decreasing term insurance is a more affordable option than whole life or universal life insurance. The death benefit is designed to mirror the amortization schedule of a mortgage or other personal debt not easily covered by personal assets or income, like personal loans or business loans.

Decreasing term insurance allows a pure death benefit with no cash accumulation, unlike, for example, a whole life insurance policy. As such, this insurance option has modest premiums for comparable benefit amounts to either a permanent or temporary life insurance.

Yearly renewable term (YRT) policies have no specified term but can be renewed each year without providing evidence of insurability. The premiums change from year to year; as the insured person ages, the premiums increase. Although there is no specified term, premiums can become prohibitively expensive as individuals age, making the policy an unattractive choice for many.

What Is Yearly Renewable Term (YRT) Insurance?

A yearly renewable term is a one-year term life insurance policy. This type of policy gives policyholders a quote for the year the coverage is bought. When someone buys a yearly renewable term insurance policy, the premium quoted is for a one-year term, starting in the current year.

At the same time next year, the insured will pay another annual premium for a person in the same situation, but one year older. In the following year, the premium increases again as it will be for the same person, two years older. Premiums increase annually in order to cover increased risk with age. This type of insurance is also referred to as increasing premium term insurance or annual renewal term assurance.

How Does Yearly Renewable Term Insurance Work?

Actuaries are in charge of figuring out what premium will be charged for a yearly renewable term, based on different risk variables. Using a specific formula for these variables, actuaries can predict at what age a policyholder will likely die. As the policyholder grows older, premiums to the policy can be added.

These policies tend to be attractive to young insurance seekers who want to start out with a low cost, flexible premium. It also pays a death benefit to any named beneficiary if the policyholder passes away within the one-year term.

The primary drawback of yearly renewable term life insurance is that if a policyholder renews for many years, they could end up paying more in premiums than if they'd bought a level term life or permanent life insurance policy. If someone buys a yearly renewable term life policy and later figures out their coverage needs are longer, the insurance company may let a policyholder convert the policy to whole life insurance without taking another medical exam.

Benefits of Yearly Renewable Term Life Insurance

Policyholders with a yearly renewable term life insurance policy can lock in a length of time during which they remain insurable. During this time, the policy can be renewed without the need for a medical exam. Renewability varies by state but is generally permissible up to a certain age.

The policyholder's age has a lot to do with how premiums are priced. A young insured person's premiums are lower and generally increase with age. That's because the older a person gets, the more costly it becomes to insure him or her. Most policies come with a "schedule of premiums." This is a chart that outlines the maximum amount you'll have to pay each year. Premiums are billed for the exact amount when the policy is renewed. While the premiums may increase, the death benefit stays the same.

Disadvantages of Yearly Renewable Term Life Insurance

If a policyholder renews for many years, they could end up paying more in premiums than if they'd bought a level term life or permanent life insurance policy. If someone buys a yearly renewable term life policy and later figures out their coverage needs are longer, the insurance company may let a policyholder convert the policy to whole life insurance without taking another medical exam.

At the same time next year, the insured will pay another annual premium for a person in the same situation, but one year older. In the following year, the premium increases again as it will be for the same person, two years older. Premiums increase annually in order to cover increased risk with age. This type of insurance is also referred to as increasing premium term insurance or annual renewal term assurance.

How Does Yearly Renewable Term Insurance Work?

Actuaries are in charge of figuring out what premium will be charged for a yearly renewable term, based on different risk variables. Using a specific formula for these variables, actuaries can predict at what age a policyholder will likely die. As the policyholder grows older, premiums to the policy can be added.

These policies tend to be attractive to young insurance seekers who want to start out with a low cost, flexible premium. It also pays a death benefit to any named beneficiary if the policyholder passes away within the one-year term.

The primary drawback of yearly renewable term life insurance is that if a policyholder renews for many years, they could end up paying more in premiums than if they'd bought a level term life or permanent life insurance policy. If someone buys a yearly renewable term life policy and later figures out their coverage needs are longer, the insurance company may let a policyholder convert the policy to whole life insurance without taking another medical exam.

Benefits of Yearly Renewable Term Life Insurance

Policyholders with a yearly renewable term life insurance policy can lock in a length of time during which they remain insurable. During this time, the policy can be renewed without the need for a medical exam. Renewability varies by state but is generally permissible up to a certain age.

The policyholder's age has a lot to do with how premiums are priced. A young insured person's premiums are lower and generally increase with age. That's because the older a person gets, the more costly it becomes to insure him or her. Most policies come with a "schedule of premiums." This is a chart that outlines the maximum amount you'll have to pay each year. Premiums are billed for the exact amount when the policy is renewed. While the premiums may increase, the death benefit stays the same.

Disadvantages of Yearly Renewable Term Life Insurance

If a policyholder renews for many years, they could end up paying more in premiums than if they'd bought a level term life or permanent life insurance policy. If someone buys a yearly renewable term life policy and later figures out their coverage needs are longer, the insurance company may let a policyholder convert the policy to whole life insurance without taking another medical exam.