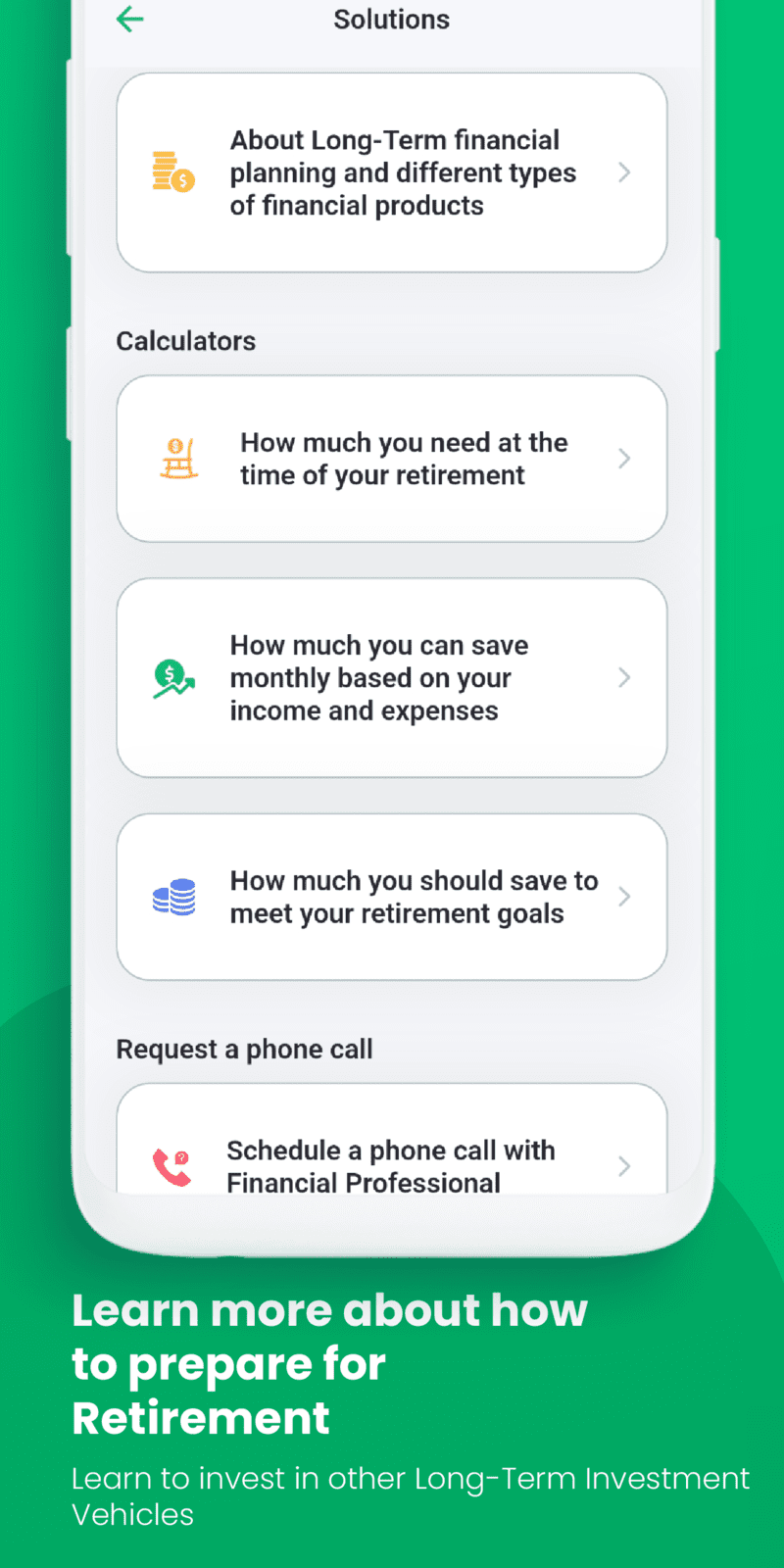

Long-Term Financial Planning

SOLUTIONS

Long-Term Financial Planning

SOLUTIONS

It all depends what you are capable of saving comfortably on monthly basis. Calculate how much you can save monthly, based on your income and expenses to determine how much you could save towards your long-term financial planning. Let’s say you have determined how much of your savings should go to long-term savings for retirement, now the question is where you should save your money , again depends of your particular situation, if you have already employer sponsored savings plan such as 401(K), 403(B) 457 or pension plan and your employer matches your contributions then you have to keep those plans and make contributions there up to certain amounts, and then concentrate more on personal savings and more Tax-Exempt accounts, because your employer sponsored plans are most probably qualified plans which means they are tax deductible and tax deferred but are taxable at the time of withdrawal (at the retirement). If you don’t have employer sponsored savings plan and if you are able to save both and qualified plans (tax deferred) and non-qualified/Tax-exempt plans then you might consider saving 50% of your funds into Tax-Deferred accounts such as Traditional IRAs, SEP IRA, SIMPLE IRAs, deferred Compensation plans and 50% into non-qualified/Tax-Exempt plan such as Roth IRA, municipal bonds or cash value Life insurance, but if your monthly savings amount is less than $500 then you might want to consider more non-qualified (Tax-Exempt) plans.

Scenario #1

If you have already employer sponsored savings plan such as 401(K), 403(B), pension plan Etc. and your employer matches your contributions then you should keep them and make contributions there up to certain amounts, if you are a self proprietor or business owner and want to create individual retirement account for yourself or for your employees or if you want to create a college plan for your kids Go to Qualified Plans for solution.

Scenario #2

If you are highly compensated employee or key executive in a company and your qualified retirement plan contributions have been maxed out which usually happens quickly given your level of compensation or if you don't have employer sponsored retirement account and you want to create individual retirement account for yourself Go to Non-Qualified Plans for solution.

Scenario #3

Option 1: If you already have traditional Tax-Deferred accounts and looking for to add Tax free accounts into your retirement portfolio go to Tax-Exempt Accounts for solutions.

Option 2: If you are someone who is looking for some type of Investment/Savings account (Retirement Strategy) which is:

- Tax-Exempt

- Liquid (no 591/2 rule)

- Puts you in a position to beat the inflation

- Has no contributions and/or Income limits

- And most Importantly where you can NEVER lose money

Our Picks

These companies are among our picks for Individual Retirement Accounts (IRA/SEP IRA/SIMPLE IRA) and Life Insurance Retirement Strategies (LIRS)

* $0 Online listed equity trades

* 24/7 Personal guidance

* Online tools and recourses

Advantages of an IRA

* Grow potential earnings tax deferred

* No income limitations to open an account

* Current year contributions may be tax-deductible

* Fidelity Traditional IRA

* Fidelity Go Traditional IRA

* Fidelity Personalized Planning & Advice Traditional IRA

* 24/7 Customer service

Advantages of a Traditional IRA

* Tax benefits

* Access to your money

* Flexibility

* Vanguard Personal Advisor Services

* Vanguard Digital Advisor

Advantages of a Traditional IRA

* No income limit

* No age limits

* Tax-deductible contributions

* No employer-plan restrictions

* Account minimum: $0

* $0 account open or maintenance fees.

* Commissions: $0 per online listed equity trades; $0 per Schwab ETF online trade in your Schwab account

SEP IRA

* Owner-only businesses or those with just a few employees

* No IRS filing or reporting

* Allows for contributions for you and any employees

* Easy to administer

SIMPLE IRA

* Businesses with up to 100 employees

* Primarily funded with employee salary-deferral contributions

* Employer-matched contributions up to 3%

* An easy and economical plan to administer

* No account fees and no minimum to open an account.

* $0 commission for online US stocks and ETFs

SEP IRA:

* Owner-only businesses or those with just a few employees

* Funded solely by employer contributions

* Easy to set up and maintain

SIMPLE IRA

* Businesses with up to 100 employees

* Funded by employee deferrals and employer contributions

* Salary deferral plan with less administration

* Electronic funding with customized contribution allocation for each participant

* Jump start your savings

* Benefit from tax breaks

* Give your money a chance to grow

* Attract and retain employees

* $0 Online listed equity trades

* 24/7 Personal guidance

* Online tools and recourses

Advantages of a Roth IRA

* Earnings grow Tax-Free

* Qualified tax-free withdrawals

* No mandatory withdrawals (unlike a Traditional IRA)

* Fidelity Roth IRA

* Fidelity Go Roth IRA

* Fidelity Personalized Planning & Advice Roth IRA

* 24/7 Customer service

Advantages of a Roth IRA

* Tax benefits

* Access to your money

* Flexibility

* Vanguard Personal Advisor Services

* Vanguard Digital Advisor

Advantages of a Roth IRA

* No RMDs (Required Minimum Distributions)

* No age limits

* No employer-plan restrictions

* No taxes for your beneficiaries

* Insurance & Protection

* Investing & Retirement

* Banking & Borrowing

* Retirement

* Investments

* Life Insurance

* Annuities

* Retirement

* Investments

* Life Insurance

* Annuities