Long-Term Financial Planning

SOLUTIONS

Long-Term Financial Planning

SOLUTIONS

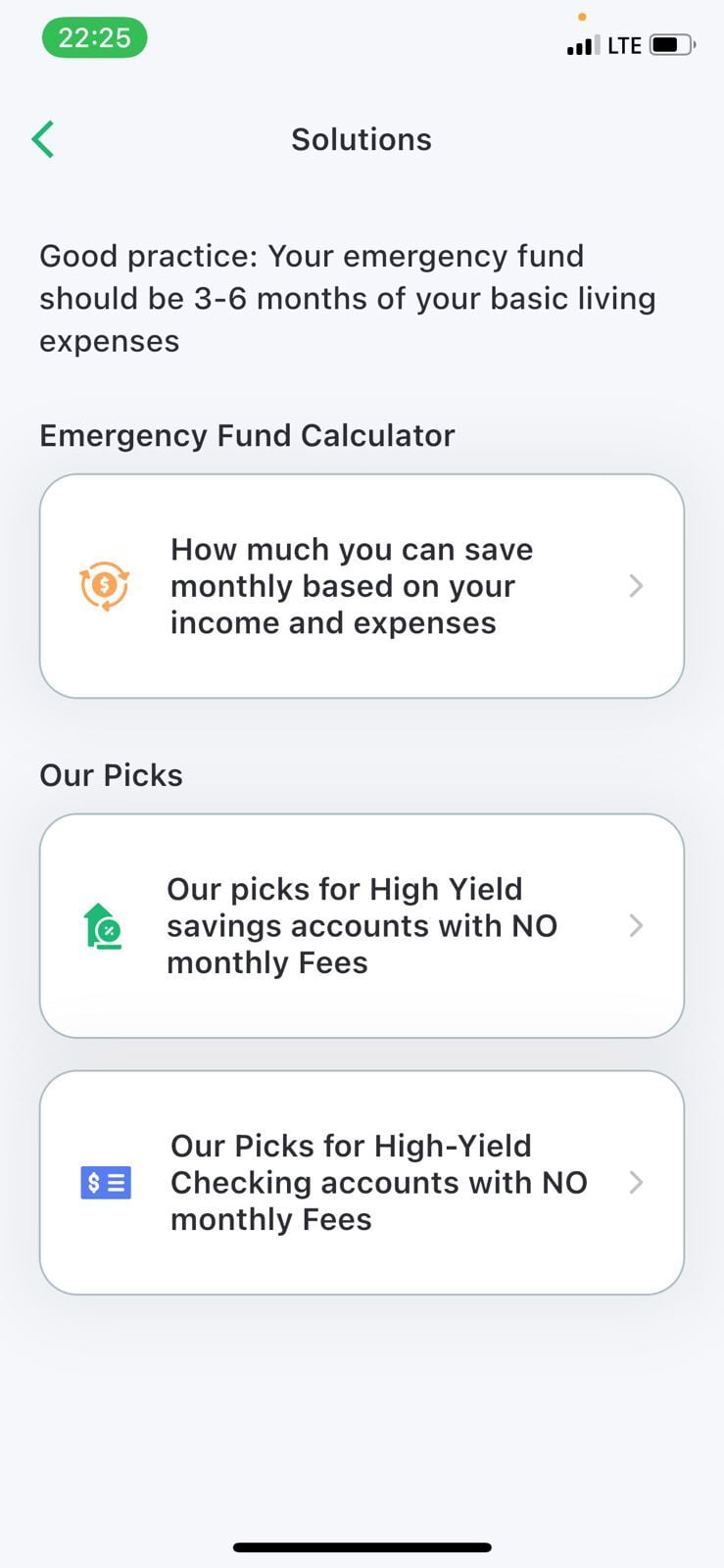

Good Practice: Your Emergency Fund should be 3 to 6 months of your basic living expenses.

Emergency Fund Calculator

Download the App to calculate How much you can save monthly based on your income and expenses and find out your Emergency Fund amount, also how much you could save towards that goal. In our opinion it's a good idea to save up to 30% of your monthly savings amount into your emergency fund.

Our Picks

These are among our picks for high yield Savings and Checking accounts with NO monthly Fees.

Axos Bank® "High Yield Savings"

Up to 0.61% APY ; Monthly Service Fees $0

Account Details

* Free ATM card upon request

* Suite of digital money management tools

* No maintenance fees

* No monthly minimum balance requirements

* $250 minimum balance to open an account

Alliant Credit Union "High-Rate Savings"

0.6% APY; Monthly Service Fees $0

Benefit overview

* Mobile App Available

* Reduced ATM Fees

Account Details

* Access anywhere with Alliant Mobile and Online Banking

* Earn more on your money with no maximum balance limit

* No monthly fee if you elect e-Statements

* Just $5 initial deposit required (and we'll pay it for you!)

* Make deposits and withdrawals at thousands of ATMs nationwide

* 0.6% APY Is 12x The Bank Industry’s Average Rate.

* Insured by NCUA up to $250,000

Marcus by Goldman Sachs Online Savings Account

0.60% APY: Monthly Service Fees $0

Account Details

* Mobile App available

* No minimum deposit to open account

* No transaction fees

* Same-day transfers of $100,000 or less

* FDIC Insured

Axos Bank® Rewards Checking

Up to 1.25% APY; Monthly Service Fees $0

Benefit overview

* Mobile App Available

* Reduced ATM Fees

* Overdraft Forgiveness

Account Details

* No Monthly Service Fees

* No Overdraft Fees

* No Minimum Balance

* Purchase Rewards Program

* Unlimited domestic ATM fee reimbursements

One Finance Spend

1.00% APY; Monthly Service Fees $0

Account Details

* Earn 1.00% APY available on Save balances up to $5,000, up to $25,000 with a qualifying paycheck direct deposit.

* 3.00% APY on up to 10% of your direct deposit.

* 3.00% APY on Auto-Save round-ups with your One card.

* Access 55,000 fee-free AllPoint ATMs across the US to easily withdraw cash.

Alliant Credit Union High-Rate Checking

0.25% APY; Monthly Service Fees $0

Benefit overview

* Mobile App Available

* Mobile Check Deposits

* No ATM Fees

Account Details

* No monthly service fees or monthly minimum balance requirements

* No overdraft fees or non-sufficient funds (NSF) item fees

* $20/month in ATM fee rebates and 80,000+ fee-free ATMs nationwide

* Free Visa, contactless debit card

* NCUA insured up to $250,000

* Feel secure with 24/7 state-of-the-art fraud monitoring and real-time fraud text alerts to approve or stop suspicious transactions